India is seeing a revival in clean-energy initial public offerings as companies capitalize on Prime Minister Narendra Modi’s push for renewables.

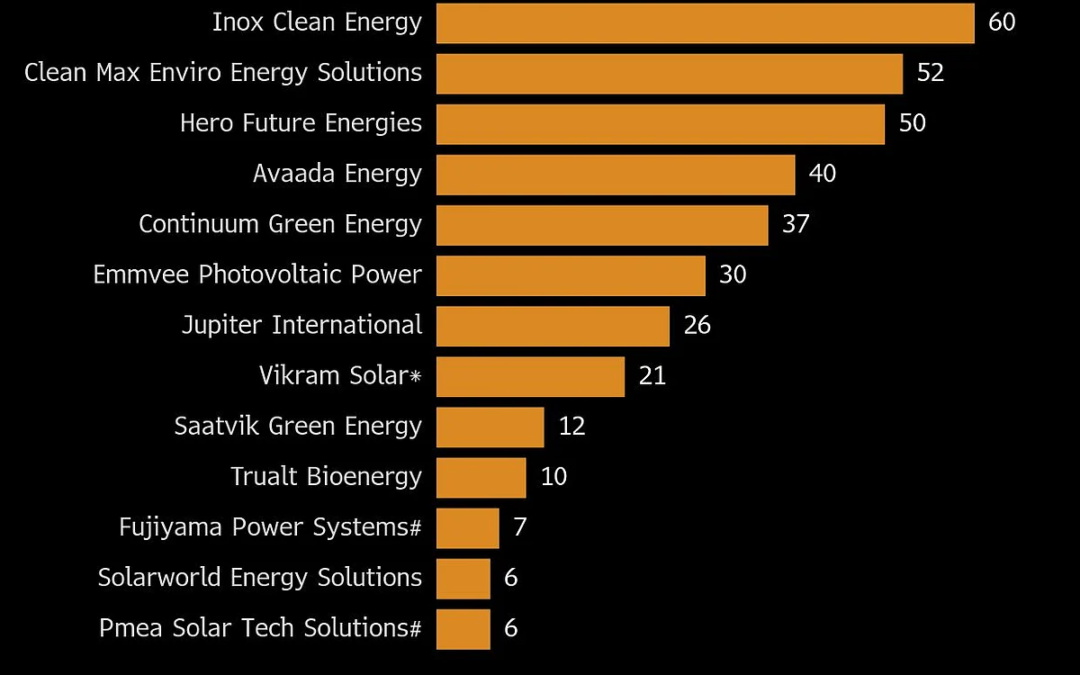

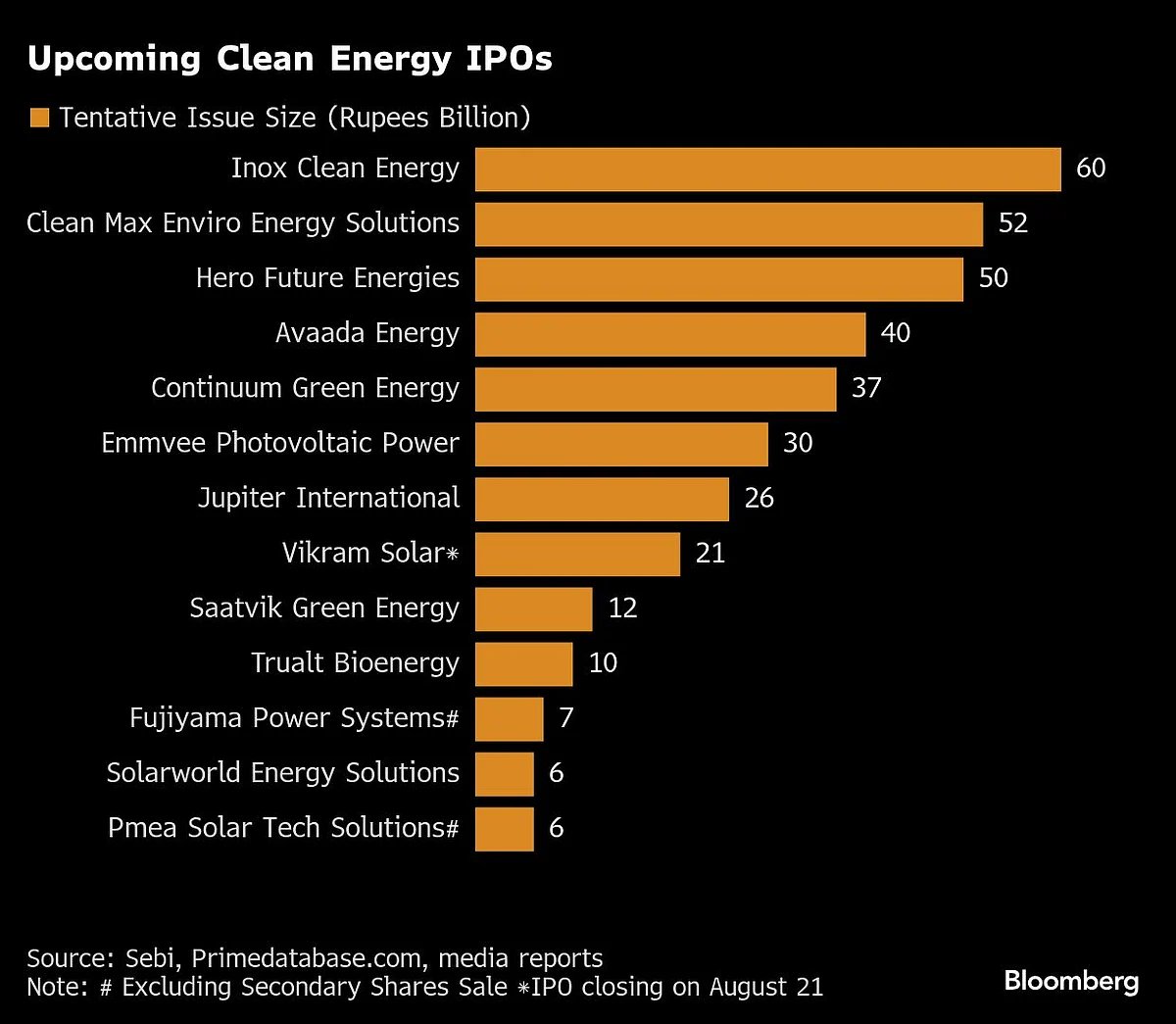

Starting with Vikram Solar Ltd. this week, more than a dozen green-energy companies have lined up to go public, seeking to raise more than $4 billion in total, according to data from primedatabase.com and local media reports. That comes after the sector saw no major offerings this year in a sharp slowdown from the $2.4 billion raised through IPOs in 2024.

The wave of green listings comes on the back of a pickup in India’s broader IPO market after a slow start to the year. A number of billion-dollar deals are on their way, and top arranger Kotak Mahindra Capital Co. expects companies to raise over $30 billion in the coming year.

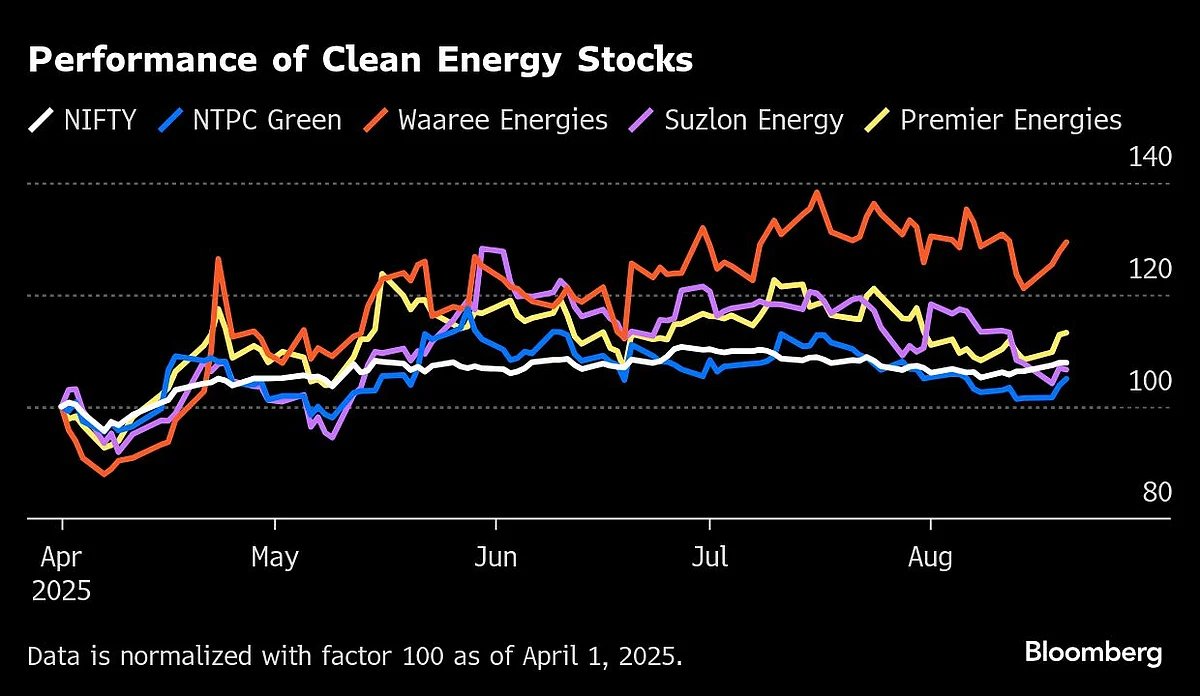

Modi’s 2030 target to more than double clean-energy capacity to 500 gigawatts — nearly equivalent to all the power plants in the UK, France and Germany combined — fueled a boom in green listings and share prices in 2024. But overheated valuations and project delays caused the frenzy to cool, and now, the deal pipeline is regaining momentum as stock prices come off their lows.

“A perfect storm of policy clarity, proven technologies and global ESG capital is powering India’s clean-energy IPO rush,” said Amit Ramchandani, managing director and chief executive officer at Motilal Oswal Investment Advisors. “Demand for round-the-clock green power is accelerating storage-linked projects.”

Modi announced an ambitious target for the world’s third-largest emitter to reach net-zero emmissions by 2070 at the COP26 climate summit in November 2021. As India ramped up production incentives, solar, electric vehicles and wind power suppliers mushroomed in the country, spawning listing candidates.

India’s installed clean-energy capacity — including nuclear power — reached 246 gigawatts in July, according to the Ministry of New and Renewable Energy. Solar led the mix with 119 gigawatts, followed by wind’s 52 gigawatts and hydropower’s 50 gigawatts.

The South Asian economy is a rare bright spot for clean energy-related IPOs, which have taken a beating globally in recent years under the weight of high interest rates and a fossil-fuel push by US President Donald Trump.

Vikram Solar closes its share sale this week, aiming to raise as much as 20.8 billion rupees ($239 million). Clean Max Enviro Energy Solutions Ltd has filed for an IPO this week, while the Securities and Exchange Board of India approved Fujiyama Power Systems Ltd.’s IPO plans in July. KKR & Co.-backed Hero Future Energies Ltd. has appointed bankers for a 50 billion rupee IPO, the Economic Times reported. The firms are part of a strong pipeline that may see shares listed over the coming year.

. Read more on Markets by NDTV Profit.