Austin, TX, USA, Aug. 21, 2025 (GLOBE NEWSWIRE) — Custom Market Insights has published a new research report titled “Europe Insect Protein Market Size, Trends and Insights By Product (Coleoptera, Lepidoptera, Hymenoptera, Orthoptera, Hemiptera, Diptera), By Application (Food and Beverages, Personal Care, Cosmetics), and By Region – Industry Overview, Statistical Data, Competitive Analysis, Share, Outlook, and Forecast 2025–2034“ in its research database.

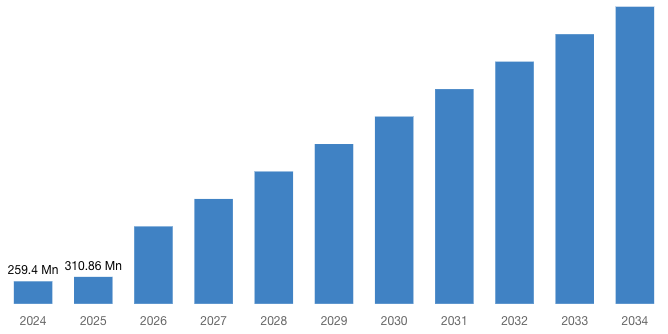

“According to the latest research study, the demand of Europe Insect Protein Market size & share was valued at approximately USD 259.4 Million in 2024 and is expected to reach USD 310.86 Million in 2025 and is expected to reach a value of around USD 3422.72 Million by 2034, at a compound annual growth rate (CAGR) of about 30.5% during the forecast period 2025 to 2034.”

Click Here to Access a Free Sample Report of the Europe Insect Protein Market @ https://www.custommarketinsights.com/request-for-free-sample/?reportid=70145

Europe Insect Protein Market Overview

As per the industry experts at CMI, the insect protein market in Europe is picking up speed fast, led by the growing demand for sustainable and high-protein alternative food sources in animal feed, pet food, and even human nutrition. Industry leaders like Protix B.V., Ÿnsect, Entomo Farms, Hexafly, and AgriProtein are driving innovation by commercializing insect farming technology, especially for black soldier flies and mealworms, and heavily investing in automated manufacturing plants, bioconversion technologies, and circular economy strategies.

Government support in the form of facilitative EU regulatory policy, research awards, and sustainability programs is driving market convergence faster. From Dutch aquaculture farms to French poultry farms and German pet food processors, the adoption of insect protein is gaining momentum as a sustainable protein compared to conventional proteins such as soy and fishmeal. In addition, strategic partnerships, waste valorization technology, and R&D on insect oil and chitin are opening up new business prospects—putting Europe at the forefront of the world’s insect protein revolution.

Request a Customized Copy of the Europe Insect Protein Market Report @ https://www.custommarketinsights.com/request-for-customization/?reportid=70145

Europe Insect Protein Market Growth Factors and Dynamics

- EU Regulatory Approvals: As per the European Union’s Novel Food Regulation (EU) 2015/2283, insect products must undergo evaluation by the European Food Safety Authority (EFSA) before being authorized for sale in the market, ensuring consumer safety and an open process for regulation. Between 2021 and 2023, the EU approved several insect species as food items, including dried mealworms, migratory locusts, house crickets, and lesser mealworm larvae. These approvals have helped companies like Protix B.V., operator of the globe’s largest insect factory in the Netherlands, to expand beyond their existing products to meet EU standards, producing safe, high-quality insect ingredients for human food and animal feed.

- Growing Demand for Pet Food and Aquaculture: Insects are gaining value as ecologically safe, high-protein feedstock to replace conventional feed materials in pet food and aquaculture with environmental benefits as they can be produced successfully and cultivated on organic waste. Protix B.V. in the Netherlands are spearheading this revolution through the production of insect-based ingredients to fulfill the nutritional requirements of animals of different kinds, minimizing the intake of resource-intensive inputs such as fishmeal and soy. Concurrently, UK-based business AgriProtein also has products like MagMeal and MagOil from black soldier fly larvae that offer sustainable feed solutions with lower greenhouse gas footprints and lower land and water usage, enabling more sustainable systems of animal nutrition.

- Circular Economy Support: Insect rearing supports the circular economy through the transformation of organic waste into valuable commodities like proteins and oils to reduce wastage and maximize efficient use of resources. AgriProtein businesses are a classic example by recycling food waste to yield black soldier flies that get processed into sustainable feed products such as MagMeal and MagOil to minimize the environmental impact of waste management and conventional feed manufacturing. Similarly, Protix B.V. applies circular principles to transform organic waste into premium insect protein, which enhances sustainability and aligns with the broader EU goals of resource efficiency and environmental protection.

Report Scope

| Feature of the Report | Details |

| Market Size in 2025 | USD 310.86 Million |

| Projected Market Size in 2034 | USD 3422.72 Million |

| Market Size in 2024 | USD 259.4 Million |

| CAGR Growth Rate | 30.5% CAGR |

| Base Year | 2024 |

| Forecast Period | 2025-2034 |

| Key Segment | By Product, Application and Region |

| Report Coverage | Revenue Estimation and Forecast, Company Profile, Competitive Landscape, Growth Factors and Recent Trends |

| Regional Scope | North America, Europe, Asia Pacific, Middle East & Africa, and South & Central America |