Oil slipped as traders turned their attention to Donald Trump’s meeting with Volodymyr Zelenskiy on Monday, with the Ukrainian leader facing US pressure to reach a peace deal with Russia that involves ceding territory.

Brent was below $66 a barrel after closing 1.5% lower in the previous session, while West Texas Intermediate was near $63. In a show of support, European leaders including European Commission President Ursula von der Leyen, French President Emmanuel Macron, and NATO Secretary-General Mark Rutte, will join the high-stakes meeting in Washington with Trump and Zelenskiy.

The US president said after his talks with Vladimir Putin in Alaska on Friday that he’ll urge Zelenskiy to make a quick deal, and sounded receptive to the Russian leader’s demand that Ukraine give up large swathes of land.

“We’re still a long ways off,” Secretary of State Marco Rubio, who took part in the summit, told Fox News on Sunday. “We are not at the precipice of a peace agreement. We are not at the edge of one. But I do think progress was made.”

Trump told European leaders after the meeting that the US could contribute to any security guarantees, and that Putin was prepared to accept that. However, it remains unclear what kind of guarantees are being discussed with the Russian leader, and what the Kremlin is willing to accept.

Prior to the summit in Alaska, Trump told allies that reaching a ceasefire would be his key demand, and threatened to walk out of the talks and impose tough new measures on Moscow and countries buying its oil if it wasn’t met. On Friday, the US president signaled he was in no hurry to implement penalties.

So far, Trump has singled out India for buying Russian crude, slapping the South Asian nation with high tariffs for doing so. However, the US president said in a Fox News interview on Friday that he will hold off increasing levies on Chinese goods due to the country’s purchases of Moscow’s crude.

“The fact that further meetings are taking place here is a positive,” said Robert Rennie, the head of commodity and carbon research at Westpac Banking Corp. He added that sparing China from tariffs related to buying Russia crude has likely put some downward pressure on prices.

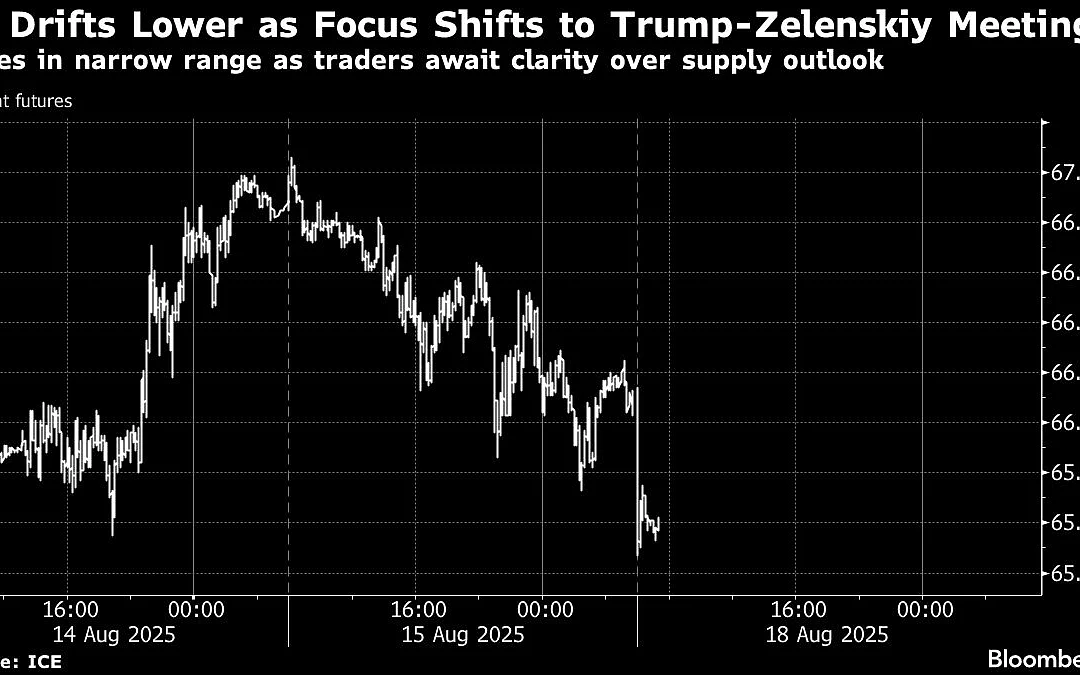

Talks around seeking a resolution to the Ukraine war have injected uncertainty into the market, and led to oil trading in a narrow range recently. Still, futures are down more than 10% this year on concerns around the fallout from Trump’s trade policies and as OPEC+ rapidly returns idled barrels to the market.

Last week, the International Energy Agency said that the market was on track for a record surplus in 2026 due to swelling supplies and slowing demand.

Prices:

-

Brent for October settlement was 0.5% lower at $65.51 a barrel at 8:05 a.m. in Singapore.

-

WTI for September delivery fell 0.4% to $62.55 a barrel.

. Read more on Markets by NDTV Profit.