Synopsis– The real estate market in India in 2025 has diverse opportunities for all real estate investors, fueled by urbanization trends, economic growth, and infrastructure improvements. This article showcases ten cities for potential investors, identifies the key influences setting locations for demand for property, offers suggestions for investors, outlines the benefits and risks of investing.

India’s real estate market is expanding steadily in 2025, supported by urban growth, stronger economies, and ongoing infrastructure projects. Both major cities and emerging towns are seeing increased property demand. This article highlights the ten cities offering the best investment opportunities, focusing on factors like rental income, price growth, and market stability.

Key Factors Driving Real Estate Investment

- Infrastructure Development: Metro rail expansions, expressways, and smart city projects are radically transforming connectivity, elevating real estate prices, and creating growth opportunities for investors.

- Economic Growth: The government’s focus on creating successful IT hubs, corporate corridors, manufacturing clusters, and up-and-coming service sectors drives demand for both residential and commercial real estate, especially among the professional classes, leading to continued demand for rentals.

- Government Policies: The wider acceptance of RERA, tax incentives, improvements in property registration, and improvements from Smart Cities Mission reforms create the rules of the game with an increased level of transparency, security, and thereby investor confidence.

- Rental Yields & Appreciation Potential: Rising cities that provide consistent rental income as well as strong long-term capital appreciation create an equal balance of immediate income and wealth creation.

- Affordability & Market Stability: Reasonable price entry points with steady, sustained market growth prospects entail a low risk and solid profitable investment opportunity.

Top 10 Cities for Real Estate Investment

1. Bengaluru (Silicon Valley of India)

- Why Invest: With a great variety of IT and startup ecosystems, there is always growth, always demand.

- Drivers: Metro lines pushing outward, outer ring road openings and holes being filled with infrastructure projects.

- Hot Spots: Whitefield, Koramangala, Sarjapur Road.

- Rental & Appreciation: Strong rental yield returns and good appreciation growth potential.

2. Hyderabad

- Why Invest: Affordable prices, burgeoning IT sector and corporate divisions continuing to grow.

- Drivers: Infrastructure growth, HITEC City, connecting early major thoroughfares.

- Hot Spots: Kondapur, Gachibowli, HITEC City.

- Rental & Appreciation: Balanced rental demands without sacrificing long-term price growth potential.

3. Pune

- Why Invest: An IT and education hub attracting young professionals and students mostly.

- Drivers: Integrated township, metro lines expanded, lifestyle residential projects.

- Hot Spots: Hinjewadi, Kharadi, Baner-Balewadi

- Rental & Appreciation: Steady demand supports ample rental yield and capital appreciation.

4. Mumbai Metropolitan Region (MMR)

- Why Invest: India’s financial capital fuels residential and commercial demand.

- Drivers: limited land, midsize new developments (Navi Mumbai International Airport).

- Hotspots: Thane, Mulund, Navi Mumbai, Panvel.

- Rental & Appreciation: High yields (10% plus), premium long-term growth.

Also read: Top 10 Indian Cities With the Best Air Quality in 2025

5. Chennai

- Why Invest: IT, manufacturing, and land-based economy grow collectively, creating consistent property demand.

- Drivers: Chennai Phase II early opening, like any sprawling city undergoing rapid, lifestyle-driven housing expansion.

- Hot Spots: OMR, Guindy, Sholinganallur, Porur.

- Rental & Appreciation: Balanced rental yield combined with longer-term appreciation potential.

6. Ahmedabad

- Reasons to Invest: A fast-growth scenario, especially in manufacturing and services, working as a Smart city.

- Drivers: A conducive environment for business, planned infrastructure, and various residential formats.

- Hotspots: Vastrapur, Prahlad Nagar, SG Highway, and Bopal.

- Rental & Appreciation: Easy entry for most investors and a good long-term prospect for appreciation.

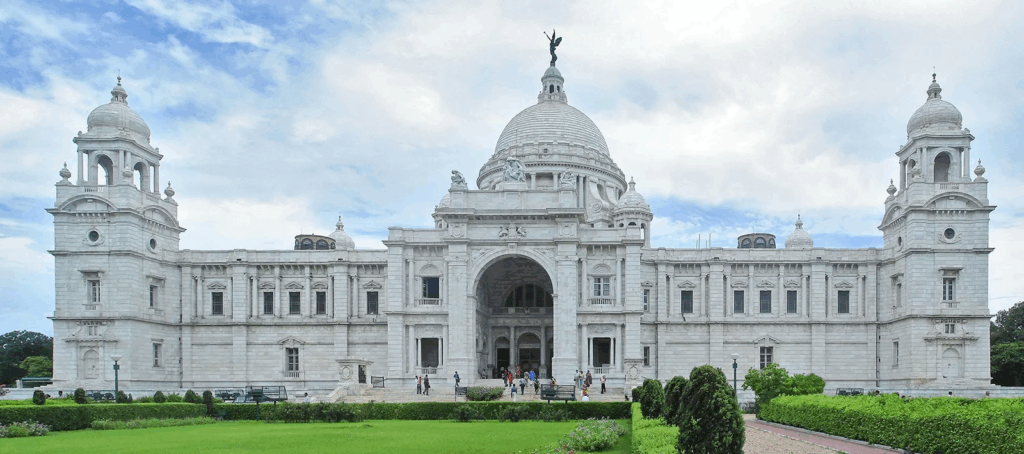

7. Kolkata

- Why Invest: Property prices are quite affordable in the emerging market.

- Drivers: Fast residential and commercial development with increased requirements for urban spaces.

- Hotspots: Rajarhat, New Town, Salt Lake City.

- Rental & Appreciation: A lower-cost option for first-time investors, with decent appreciation prospects.

8. Gurgaon (Gurugram)

- Why Invest: An established corporate corridor near Delhi, with luxury and mid-tier housing.

- Drivers: Excellent infrastructure, availability of corporate offices, and metro connectivity.

- Hotspots: Golf Course Road and Dwarka Expressway.

- Rental & Appreciation: Residential and commercial investment, with premium prospects for returns.

9. Noida

- Why Invest: Part of Delhi-NCR and witnessing rapid growth in corporate activity and urban developments.

- Drivers: Excellent connectivity via metro and considerable mixed-use development potential, with good amenities expected.

- Hotspots: Sector 150 and Central Noida, & Greater Noida.

- Rental & Appreciation: High rental activity potential and good prospects for price growth in the long term.

10. Kochi

- Why Invest: Along the coast with external NRIs and emerging market investors.

- Drivers: Metro development and significant coastal revamp, and growth in the economy

- Hotspots: Kakkanad, Edapally, Vyttila, Panampilly Nagar.

- Rental & Appreciation: A constant rental demand and meaningful appreciation potential.

Tips for Real Estate Investors

Confirm property titles, approvals, and compliance with regulations before making a purchase. Understand the potential for growth, connections, and other current or potential infrastructure projects to identify areas with potential. Place expected rental yield in context of capital appreciation, depending on whether you are aligned with a long-term or short-term strategy. Be aware of changes or presentation of regulations, incentives and other reform processes that occur in the real estate market. Make your investment decisions based on the quality of the projects you are looking to build with construction professionals who have a long track record of quality, timely delivery, and project ownership.

Conclusion

India’s diverse real estate market includes multiple investment options throughout established and emerging cities. Selecting locations relative to their realization (rental income, future appreciation, or both—combined with research and due diligence) maximizes returns and minimizes risks and ultimately realizes strategic and profitable investment decisions through informed decision-making.

Written by N G Sai Rohith

The post 10 Best Cities For Real Estate Investment In India 2025 – See Where You Should Buy Next appeared first on Trade Brains.