SHANGHAI, Aug. 14, 2025 /PRNewswire/ — CARsgen Therapeutics Holdings Limited (Stock Code: 2171.HK), a company focused on developing innovative CAR T-cell therapies, has announced its 2025 Interim Results.

Business Highlights

- Cash and bank balances were around RMB1,261 million as of June 30, 2025. Cash and cash equivalents and deposits at the end of 2025 are expected to be not less than RMB1,100 million. We expect to have adequate cash into the 2028 excluding subsequent cash inflows.

- During H1 2025, certification and regulatory filings for zevor-cel have been completed in more than 20 provinces or cities. CARsgen has received a total of 111 confirmed orders from its commercialization partner Huadong Medicine.

- The Center for Drug Evaluation (CDE) of the National Medical Products Administration (NMPA) of China has accepted the New Drug Application (NDA) for satri-cel.

- The results of satri-cel confirmatory Phase II trial in China have been published in The Lancet and at the 2025 ASCO Annual Meeting.

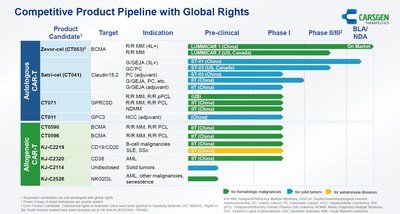

- Multiple allogeneic CAR-T products are in development, covering treatment areas such as hematologic malignancies, solid tumors, and autoimmune diseases.

- CARsgen introduced Zhuhai SB Xinchuang to accelerate allogeneic CAR-T development in mainland China.

Dr. Zonghai Li, Founder, Chairman of the Board, Chief Executive Officer, and Chief Scientific Officer of CARsgen Therapeutics, said, “In the first half of 2025, we made significant strides across technology innovation, product development, and commercialization. Zevor-cel sales surged, while satri-cel became the world’s first CAR-T targeting solid tumors to file an NDA. We are also advancing multiple allogeneic CAR-T therapies to enhance clinical outcomes and expand patient access.”

Financial Highlights

CARsgen’s revenue was around RMB51 million for the six months ended June 30, 2025, mainly from zevor-cel, which was calculated on the basis of ex-works price, rather than end-of-market prices. Our revenue is recognized upon completion of ex-works delivery of products. Due to the inherent time cycle of CAR-T manufacturing, there is a discrepancy between the number of orders obtained from Huadong Medicine and number of ex-works deliveries. CARsgen’s gross profit was around RMB29 million for the six months ended June 30, 2025. In the commercialization stage, we are demonstrating a strong cost competitive advantage, which is mainly due to self-manufacture for plasmids and vectors with stable output and high yield per batch.

Cash and bank balances were around RMB1,261 million as of June 30, 2025, representing a decrease of around RMB218 million from around RMB1,479 million as of December 31, 2024. The decrease was mainly due to the payment of research and development expenses, administrative expenses and investment of capital expenditure. Cash and cash equivalents and deposits at the end of 2025 are expected to be not less than RMB1,100 million. We expect to have adequate cash into the 2028 excluding subsequent cash inflows.

Zevor-cel Demonstrates …