Austin, TX, USA, Aug. 13, 2025 (GLOBE NEWSWIRE) — Custom Market Insights has published a new research report titled “US Remittance Market Size, Trends and Insights By Service Type (Online Remittance Services, Traditional Remittance Services, Mobile Remittance Services, Cryptocurrency-based Remittance Services), By Sender (Migrant Workers, Business Owners, Expatriates), and By Region – Industry Overview, Statistical Data, Competitive Analysis, Share, Outlook, and Forecast 2025–2034“ in its research database.

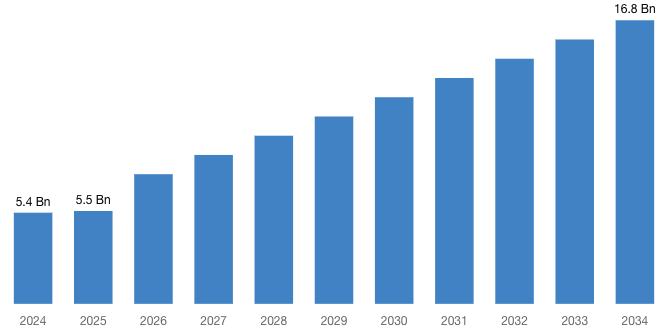

“According to the latest research study, the demand of the US Remittance Market size & share was valued at approximately USD 5.4 Billion in 2024 and is expected to reach USD 5.5 Billion in 2025 and is expected to reach a value of around USD 16.8 Billion by 2034, at a compound annual growth rate (CAGR) of about 12.07% during the forecast period 2025 to 2034.”

Click Here to Access a Free Sample Report of the US Remittance Market @ https://www.custommarketinsights.com/request-for-free-sample/?reportid=72018

Overview

According to a senior analyst with CMI Research, the U.S. remittance market will dramatically transform as a result of new digital-first solutions, as well as blockchain-based remittances that will challenge traditional methods used by migrants, expatriates, and entrepreneurs for cross-border transfers. The potential efficiencies—expanded due to regulatory modernization, new crypto corridors, and embedded digital financial tools—will hopefully develop into new marketplaces through 2034r payments. Through 2034, we expect regulatory modernization, new crypto corridors, and embedded digital financial tools to introduce new efficiencies and potential market offerings.

Key Trends & Drivers

- Steady Increase in Migration and Global Workforce Mobility: Migration is still a significant consumer macro driver in the remittance ecosystem. The United States has always been one of the key destinations for migrants from across the globe. Consequently, the millions of workers still in the States sending money back home will inevitably support family members back in their countries of origin, namely Latin America, Asia, Africa, and the Caribbean. For example, remittance flows between Mexico and the U.S. and India and the U.S. in 2023 were at an all-time high, which indicates that remittance payments serve as an important source of support for many developing economies.

- Accelerated Adoption of Mobile and Digital Remittance Solutions: Cash transfers are being replaced with mobile-first applications and web-based remittance solutions. Companies such as Wise, Remitly, WorldRemit, and Xoom are leading in this space by providing fee transparency, competitive exchange rates, and real-time tracking. The ubiquity of smartphones globally, even within low-income migrant communities, enables direct P2P flows without having to rely on an agent-dependent network.

Request a Customized Copy of the US Remittance Market Report @ https://www.custommarketinsights.com/request-for-customization/?reportid=72018

- Blockchain and Cryptocurrency-supported Cross-border Transfers: The emergence of crypto-supported next-generation rail systems, such as RippleNet corridors and stablecoin-supported transfers, offers faster and more cost-effective solutions than wire systems. In addition, these blockchain channels employ numerous intermediaries as well as foreign exchange conversion costs, enabling almost instant settlements. The speed of settlement and predictability provided by blockchain, in these scenarios, are essential for migrant workers.

- Expanding Access to Digital Financial Services in Developing Markets: More recipients are opening mobile wallets and digital bank accounts with trusted organizations in their home countries, allowing recipients of U.S.-origin remittances to increasingly receive funds directly into their mobile or digital wallets. This financial inclusion in rural areas can ‘jump start’ inclusivity, where access to financial services is limited.

- A Supportive Regulatory Environment: Efforts to support the UN SDGs to lower global remittance transaction fees below 3% have created a more supportive regulatory environment. In the U.S., trusted anti-money laundering and know-your-customer regimes and compliance frameworks help to restore trust in the consumer environment, which has allowed fintech ideas to gain legitimacy and advance.

Report Scope

| Feature of the Report | Details |

| Market Size in 2025 | USD 5.5 Billion |

| Projected Market Size in 2034 | USD 16.8 Billion |

| Market Size in 2024 | USD 5.4 Billion |

| CAGR Growth Rate | 12.07% CAGR |

| Base Year | 2024 |

| Forecast Period | 2025-2034 |

| Key Segment | By Service Type, Sender and Region |

| Report Coverage | Revenue Estimation and Forecast, Company Profile, Competitive Landscape, Growth Factors and Recent Trends |

| Country Scope | US |