Ether climbed past $4,000 for the first time since December, lifted by surging investor flows into spot exchange-traded funds and growing demand from companies building up stockpiles of the token on their balance sheets.

The second-largest cryptocurrency rose as much as 3.5% to $4,013 on Friday in New York before easing to about $3,965 as of noon. Ether is now up nearly 190% from its April low, fueled by record-breaking flows into funds directly investing in the token.

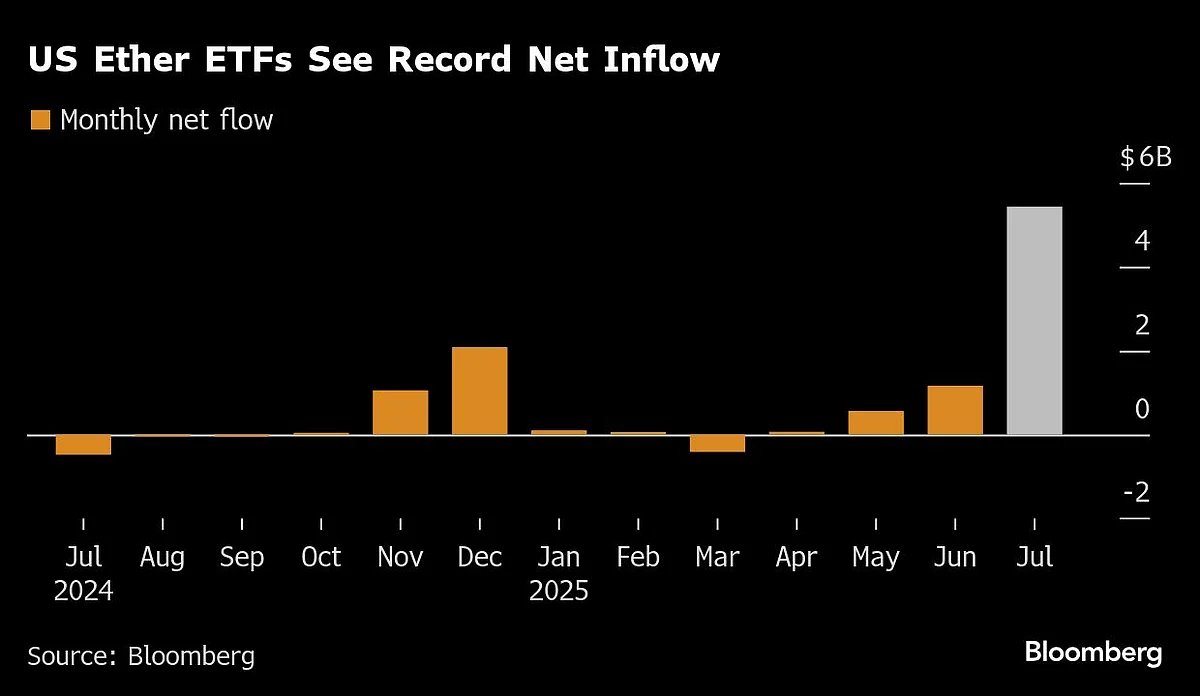

More than $6.7 billion has poured into the nine US-listed Ether spot ETFs year to date. At the same time, Ether-focused “digital-asset treasury firms” — companies that are essentially vehicles for amassing holdings of the toke — have scooped up more than $12 billion worth of the cryptocurrency, based on figures from tracking site strategicethreserve.xyz.

The token’s momentum also coincides with a broader rotation within digital assets, as institutional allocators and developers look beyond Bitcoin amid growing adoption of stablecoins as well as tokenized real-world assets and smart-contract platforms, many of which run on the Ethereum blockchain. Ether is the native cryptocurrency of that network.

“Bitcoin dominance has started to fall meaningfully as banks, fintechs, and corporates embrace stablecoins, many of which will be settled on open-source blockchains like Ethereum,” said Matthew Sigel, head of digital assets research at VanEck. “Capital markets are still very open to digital-asset treasury companies, which is adding buying pressure in the ETH spot market.”

Ether’s resurgence comes after a long period of underperformance relative to market leader Bitcoin and upstart rivals such as Solana. Despite recent gains, the token remains about 18% below its November 2021 all-time high of roughly $4,867.

. Read more on Crypto by NDTV Profit.