Payments-focused cryptocurrency XRP (XRP) has surged 12% over the past 24 hours, outperforming both bitcoin (BTC) and ether (ETH). This double-digit gain has lifted XRP’s price to $3.32, its highest level since July 28.

The price upswing has been underpinned by sophisticated, anticipatory block option trades on Deribit, involving a bullish bet on volatility. Block trades are large transactions executed over-the-counter and outside of the public order book to minimise their impact on the prevailing market price of an asset.

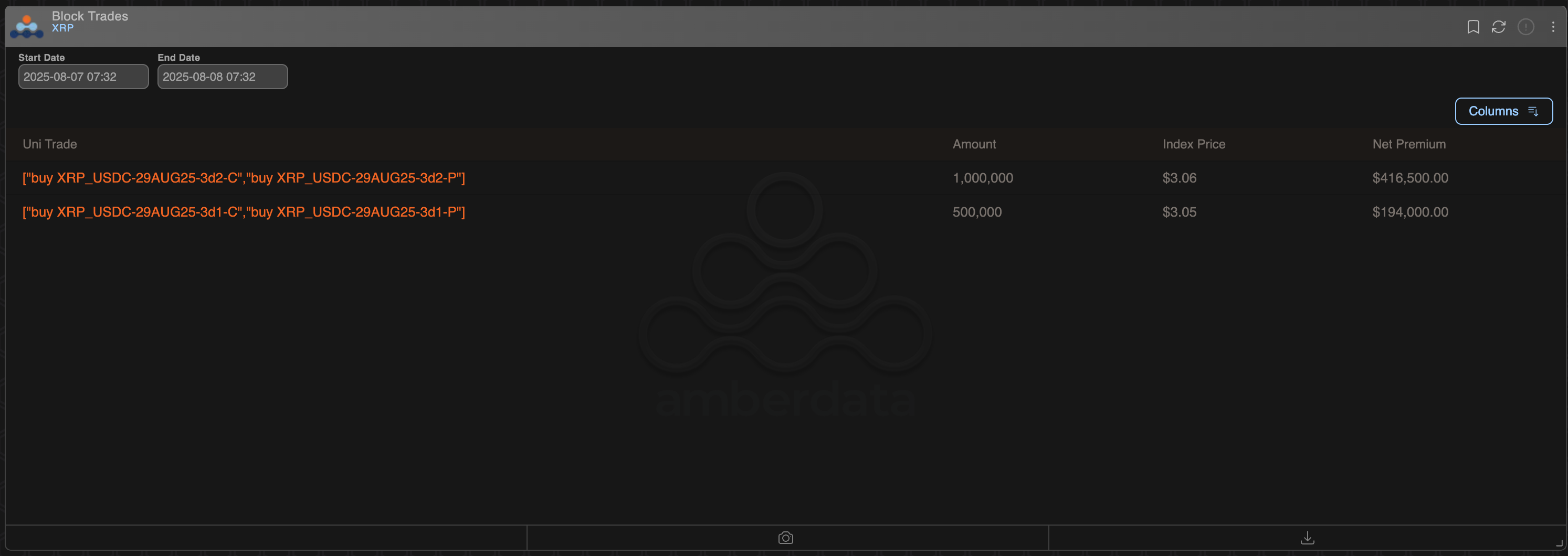

The first block trade executed on Thursday involved the simultaneous purchase of 100,000 contracts of the Aug. 29 expiry call and put options at the $3.20 strike. The trader paid over $416,000 in premiums for the so-called long straddle strategy, which stands to profit from wild swings in either direction. A similar large straddle was also booked at the $3.10 strike.

The large non-directional flow points to growing institutional interest in XRP, Deribit’s Asia Business Head Lin Chen told CoinDesk.

“XRP has outperformed BTC this year, and we are now seeing a surge in block trades and institutional interest in XRP options. We have also launched year-end XRP options to cater to this demand,” Chen said.

Traders use straddles when anticipating a major volatility event – such as a big earnings report, a key court ruling, or a significant product launch – but are uncertain whether the impact would be bullish or bearish. The risk-reward profile of a long straddle is defined by unlimited profit potential and limited risk.

Coincidentally, on Thursday, the Securities Exchange Commission and Ripple jointly agreed to drop their appeals in the Second Circuit court case, bringing to an end to a prolonged legal tussle. Ripple uses XRP to facilitate cross-border transactions.

Limited loss, unlimited gain strategy

The maximum loss in long straddles is capped at the total premium paid for both the call and the put.

The maximum profit, however, is unlimited as the price can theoretically move up or down indefinitely. To break even, the price must move in either direction by an amount equal to the total premium paid.

Options are derivative contracts designed to protect traders from bullish or bearish volatility. A call option provides cover against uptrends in the underlying asset, while a put option offers insurance against market swoons.