European stocks erased an advance and US equity futures posted modest gains as investors assessed US President Donald Trump’s latest tariff threats, disappointing economic data and a rush of corporate earnings reports.

The Stoxx Europe 600 benchmark was little changed after climbing as much as 0.4% amid mixed results from some of the region’s biggest companies. Contracts on the S&P 500 added about 0.3% as traders await earnings from firms including McDonald’s Corp. and The Walt Disney Co.

Data Tuesday showed weakening US services amid sticky price pressures, raising concern about the Federal Reserve’s policy challenges. Trump ramped up his tariff blitz, saying he’ll impose increased levies on countries buying energy from Russia and announce duties on semiconductor and pharmaceutical imports soon. Still, robust earnings and wagers on lower interest rates are buoying stocks so far.

“Overall, stocks are supported by decent earnings on both sides of the Atlantic, which is neutralizing some of the concerns around a slowdown in the US and the effects on the global economy from President Trump’s continuing obsession with tariffs,” said Kathleen Brooks, research director at XBT.

Among companies reporting in Europe on Wednesday:

-

Fresenius SE shares advanced after the health-care provider lifted its sales outlook

-

Bayer AG shares fell after the German chemicals firm’s crop science unit missed sales estimates

-

Commerzbank AG announced a share buyback of as much as €1 billion ($1.2 billion)

-

Novo Nordisk A/S fluctuated after after providing more details of a difficult quarter for the Danish drugmaker

-

Vonovia SE rallied as the real estate company boosted its forecast for the full year

-

Glencore Plc slipped after missing earnings estimates

-

ABN Amro Bank NV fell more than 6% after missing net income forecasts

-

Zalando SE rallied after the online retailer narrowed its full-year revenue forecast

-

Beiersdorf AG slumped after the maker of personal-care products reported weaker-than-expected sales growth and cut its guidance

-

Siemens Energy AG fluctuated after saying it expects to reach to upper end of its full-year guidance

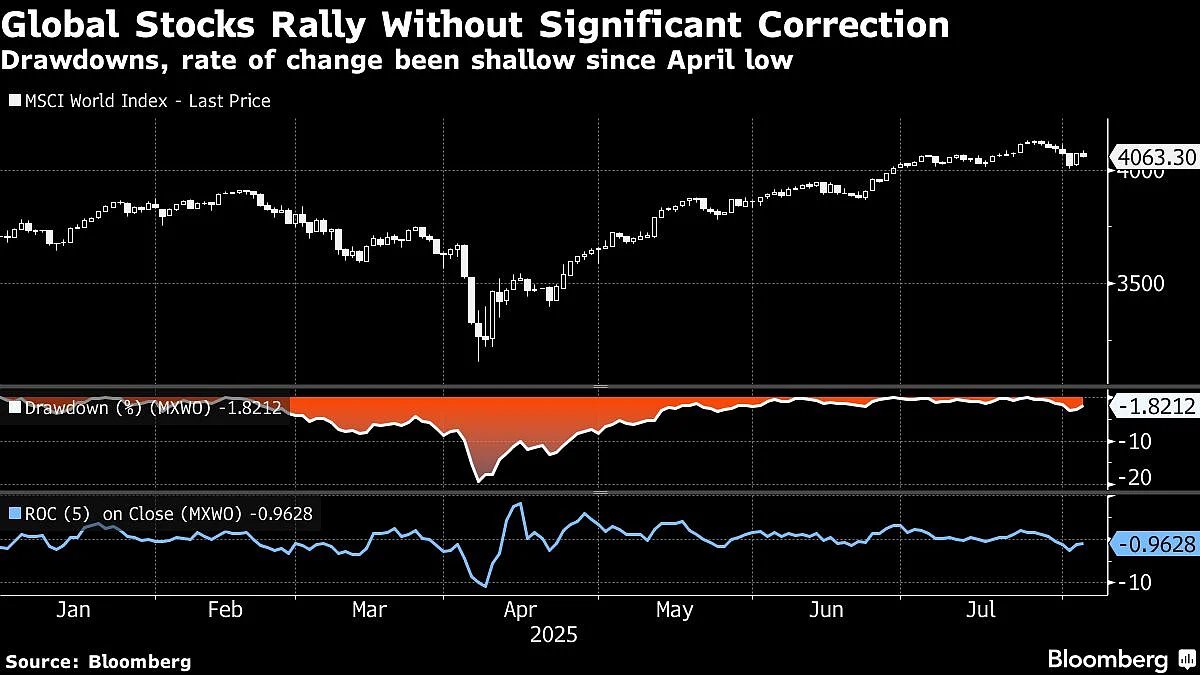

US stocks are near record highs as investors flock back into technology heavyweights and the AI trade at a time when data signals economic growth might be slowing. Betting against the market momentum “feels almost irrational,” according to Paolo Schiavone, a macro trader at Goldman Sachs Group Inc.

Any selloff would provide opportunities for equity investors, though they should prepare for volatility, said UBS Wealth Management’s Chief Investment Officer Mark Haefele.

“While trade uncertainty and elevated valuations could be a modest headwind for equities in the near term, investors can consider ways to manage volatility while positioning for longer-term gains,” Haefele said. “Those who are already allocated to equities in line with their strategic benchmarks should consider implementing short-term hedges, and those under-allocated should prepare to add exposure on potential market dips.”

Treasuries dipped, with the 10-year yield rising three basis points to 4.24% ahead of an auction of 10-year notes later Wednesday. A gauge of the dollar was steady.

What Bloomberg’s Strategists Say…

“The euro’s recent slide against the dollar may prove short-lived. With euro-area inflation sitting right on target and the recent trade agreement with Washington reducing external risk, the ECB can afford to pause, which can set the rate gap to swing in the euro’s favor.”— Nour Al Ali, Macro Markets & Squawk. Click here for the full analysis.

In other European news, German factory orders unexpectedly declined for a second month in June, when the results of a European-US trade deal were still far from clear. the data came after outgoing Governing Council member Robert Holzmann said the European Central Bank shouldn’t lower borrowing costs again.

Meanwhile, Swiss President Karin Keller-Sutter arrived in Washington to make a last-minute bid for a deal to lower the 39% tariff imposed last week by Trump.

In commodities, oil ticked higher after a four-day drop as investors waited to see whether President Donald Trump would impose secondary tariffs on buyers of Russian energy in a bid to increase pressure on Moscow.

Some of the main moves in markets:

Stocks

-

The Stoxx Europe 600 was little changed as of 10:02 a.m. London time

-

S&P 500 futures rose 0.3%

-

Nasdaq 100 futures rose 0.2%

-

Futures on the Dow Jones Industrial Average rose 0.4%

-

The MSCI Asia Pacific Index rose 0.1%

-

The MSCI Emerging Markets Index fell 0.3%

Currencies

-

The Bloomberg Dollar Spot Index was little changed

-

The euro was little changed at $1.1578

-

The Japanese yen fell 0.1% to 147.84 per dollar

-

The offshore yuan was little changed at 7.1945 per dollar

-

The British pound was little changed at $1.3287

Cryptocurrencies

-

Bitcoin rose 0.2% to $113,934.14

-

Ether rose 1.2% to $3,619.47

Bonds

-

The yield on 10-year Treasuries advanced three basis points to 4.24%

-

Germany’s 10-year yield advanced two basis points to 2.65%

-

Britain’s 10-year yield advanced two basis points to 4.54%

Commodities

-

Brent crude rose 1.3% to $68.52 a barrel

-

Spot gold fell 0.4% to $3,366.25 an ounce

. Read more on Markets by NDTV Profit.