Q1 Results Live: Axis Bank Asset Quality Worsens

Axis Bank Q1 Highlights (Standalone, YoY)

-

NII up 1% to Rs 13,559.75 crore versus Rs 13,448.23 crore

-

Net Profit down 3.8% to Rs 5,806 crore versus Rs 6,035 crore

-

Provisions up 94% to Rs 3,948 crore versus Rs 2,039 crore

-

Net NPA at 0.45% versus 0.33% (QoQ)

-

Gross NPA at 1.57% versus 1.28% (QoQ)

Q1 Results Live: Wipro Profit Down 7%, Meets Estimates

v

Q1 Results Live: Sterling And Wilson Profit Jumps Over Sevenfold

Sterling and Wilson Renewable Energy Q1 Highlights (Consolidated, YoY)

-

Revenue up 92.5% to Rs 1,761.63 crore versus Rs 915.06 crore.

-

Ebitda at Rs 85.46 crore versus Rs 24.68crore.

-

Margin at 4.9% versus 2.7%.

-

Net Profit up multifold to Rs 31.97 crore versus Rs 4.19 crore.

Q1 Results Live: LTIMindtree Estimated Earnings

LTIMindtree Ltd. will also be reporting its results for the quarter on Thursday. The company is likely to report a net profit of Rs 1,194.1 crore and revenue of Rs 9,855.4 crore for the first quarter, according to estimates. Its EBIT is expected at Rs 1,416 crore, while margin will be at 14.3%.

HDFC Bank Q1 Results Preview: Higher Provisions, Soft Loan Growth On Cards

While softer credit growth has reduced the bank’s credit-to-deposit ratio, the headline reported number was slower than average industry loan growth of 5% on year. The bank’s CD ratio has improved to 95% on quarter, Kotak Institutional Equities said.

Slower loan growth will also impact the bank’s net interest income due to fall in yield on advances outpacing cost of deposits, Yes Securities said.

Q1 Results Live: Heritage Foods Profit Falls

Heritage Foods Q1 Highlights (Consolidated, YoY)

-

Revenue up 10% to Rs 1,137 crore versus Rs 1,033 crore.

-

Ebitda down 21.2% to Rs 73.8 crore versus Rs 93.7 crore.

-

Margin at 6.5% versus 9.1%.

-

Net Profit down 30.7% to Rs 40.5 crore versus Rs 58.4 crore.

Q1 Results Live: Polycab Profit Rises

Polycab Q1 Highlights (Consolidated, YoY)

-

Revenue up 25.7% to Rs 5,906 crore versus Rs 4,698 crore.

-

Ebitda up 47% to Rs 858 crore versus Rs 583 crore.

-

Margin at 14.5% versus 12.4%.

-

Net Profit up 49.6% to Rs 592 crore versus Rs 396 crore.

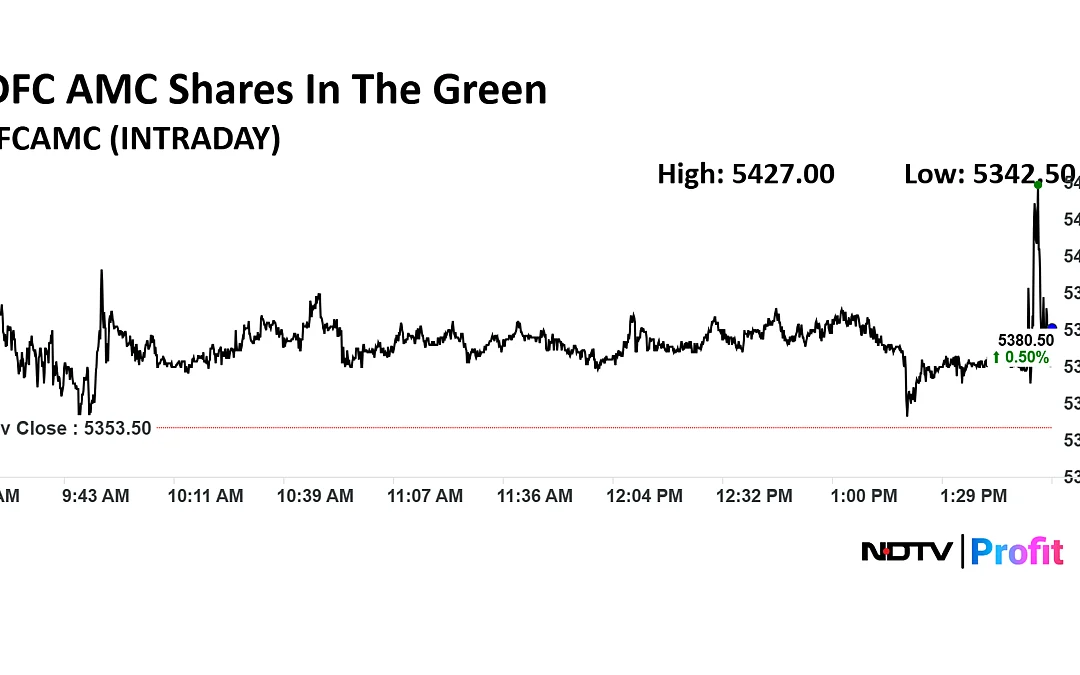

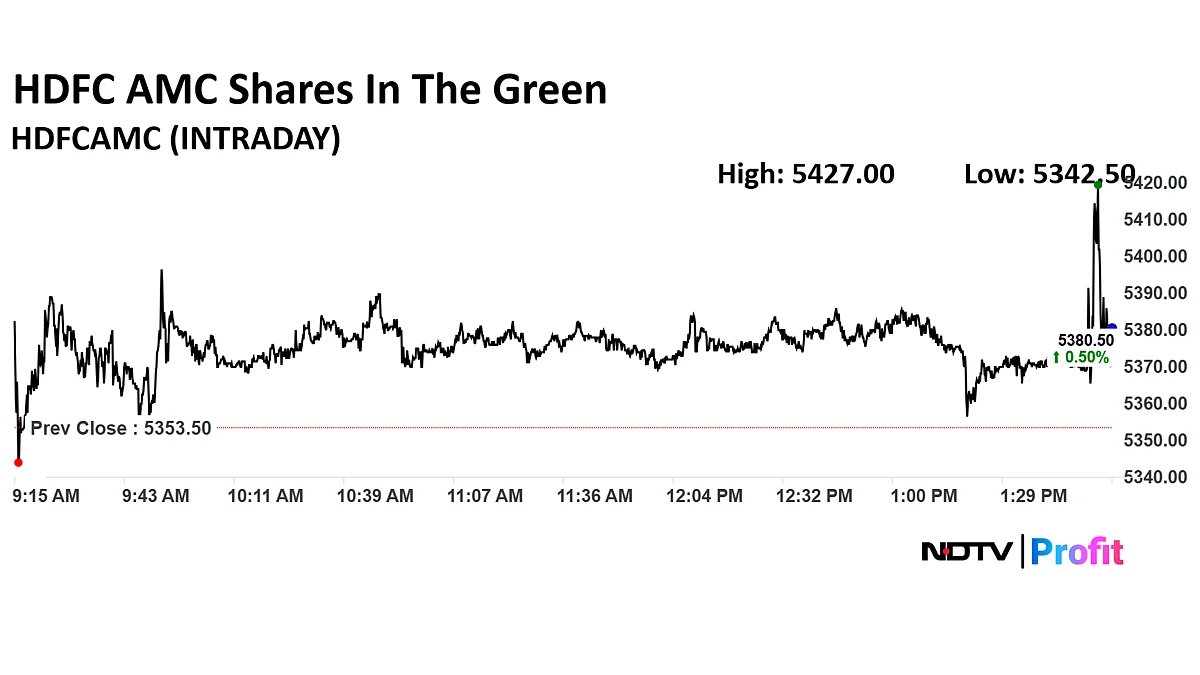

Q1 Results Live: HDFC AMC Share Price In Green

Shares of HDFC Asset Management Company was trading marginally higher after the company posted a 24% uptick in its first quarter results. The Nifty 50 was trading 0.13% lower as of 2:00 p.m.

Q1 Results Live: HDFC AMC Profit Rises

HDFC AMC Q1 Highlights (YoY)

-

Total Income up 26.6% to Rs 1,200 crore versus Rs 948 crore.

-

Net Profit up 23.8% to Rs 748 crore versus Rs 604 crore.

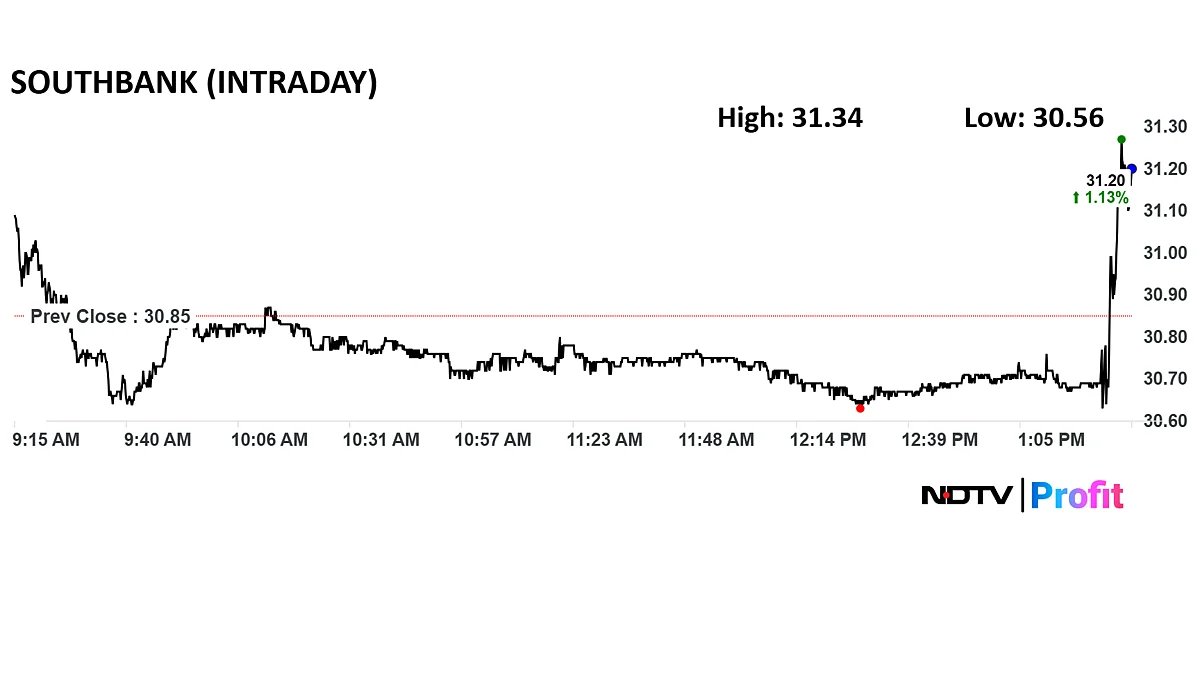

Q1 Results Live: South Indian Bank Shares Trade Higher

South Indian Bank shares were up 1% after Q1 results showed a profit jump.

Q1 Results Live: South Indian Bank Profit Up, NII Down

South Indian Bank Q1 FY26 (Standalone, YoY)

-

Net profit up 9.5% at Rs 322 crore versus Rs 294 crore

-

Net Interest Income down 3.8% at Rs 833 crore versus Rs 866 crore

-

Gross NPA at 3.15% versus 3.2% (QoQ)

-

Net NPA at 0.68% versus 0.92% (QoQ)

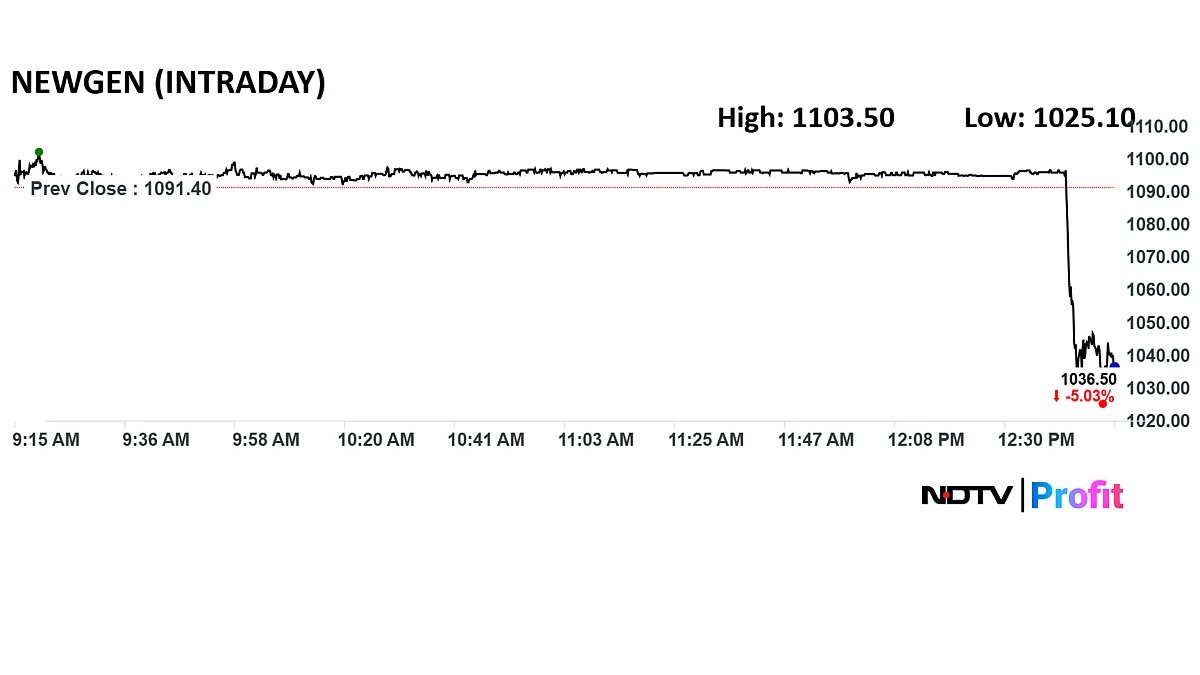

Q1 Results Live: Newgen Software Key Takeaways

-

Profit halved

-

Indian segment suffered the most, down 29%.

-

Employee cost down 13% sequentially.

-

Other incomes add some support, rising 164%.

-

Employee cost to revenue is at 52% versus 40% in Q4.

Q1 Results Live: Newgen Software Shares Slide After Disappointing Earnings

Shares of Newgen Software Technologies slide 5% after poor Q1 earnings.

Q1 Results Live: Newgen Software Earnings Decline

Newgen Software Q1 FY26 (Consolidated, QoQ)

-

Revenue down 25.4% at Rs 321 crore versus Rs 430 crore

-

EBIT down 72% at Rs 35.94 crore versus Rs 129 crore

-

EBIT margin at 11.2% versus 29.9%

-

Net profit down 54% at Rs 49.7 crore versus Rs 108 crore.

Axis Bank Q1 Results Live: Margin Pressure To Persist, Slippages Seen Elevated

Axis Bank Ltd. is set to announce its June quarter results on Thursday, with analysts expecting mixed performance on account of pressure on margins, elevated slippages, and a seasonal uptick in operating costs.

According to a poll by Bloomberg, India’s third-largest private sector bank is likely to report standalone profit after tax of Rs 6,375.77 crore, up over 5% on year. The bank’s bottomline was Rs 7,117.5 crore a quarter ago.

-

Net Profit seen up over 5% at Rs 6,375.77 crore.

-

NII seen at Rs 13,970 crore, down 4%

-

NIM seen at 3.81%, lower than 3.97% (QoQ).

Read Axis Bank Q1 preview here.

Wipro Q1 Results Live: Analysts See Muted Growth, Margin Pressure Likely

Wipro Ltd. is set to announce its financial results for the first quarter of the financial year ending March 2026 on Thursday, with analysts expecting subdued performance amid weak client spending and macro uncertainties. The focus will be on its revenue trajectory, margin movement, and Q2 guidance.

Read Wipro Q1 Preview here.

-

Revenue seen down 2% to Rs 22,094 crore from Rs 22,504 crore

-

EBIT seen down 4% to Rs 3,779 crore from Rs 3,931 crore

-

EBIT margin expected at 17.1% versus 17.4%

-

Profit seen down 9% to Rs 3,252 crore from Rs 3,570 crore

Q1 Results Live: 37 Companies To Share Earnings Report Today

As many as 37 companies are set to announce their financial performance for the quarter ended June 2025 on July 17. These companies belong to major sectors, including financial services, energy, and real estate, among others.

The leading players scheduled to release their June quarter results on Thursday include LTIMindtree, Jio Financial Services, Waaree Renewable Technologies and Axis Bank, among others.

. Read more on Earnings by NDTV Profit.