Do we have anything to highlight over the week ended? Unfortunately, except for disappointment, nothing else.

When the last week closed so well, creating what looked to be a decisive breakout, there was much hope that the market would move strongly. Most analysts, me included, were willing to state that the Nifty had certainly opened the door to test the all-time highs and perhaps best it soon. We were quite encouraged by the fact that the Bank Nifty was in good shape to help the Nifty to achieve its goal of a new high.

But all of that excitement and hopes had to be put on hold with the rather tepid performance we got from the markets in the last week. Both indices started the week well but then lost their tempo almost immediately. One always keeps searching for a reason to justify what the market did what it did- but in the larger scheme of things, does it really matter? Not really. When your forecasts and plans attendant thereto are all for continued bullishness, the market has no business doing different, isn’t it? Chart 1 details a tale of this disappointment.

This picture is in two parts. The main charts shows the intra day detail of the move thru the week- a regular lower top- lower bottom. Gasp! It went below 25500! That was not supposed to happen, shouted some.

But the picture also has an inset- the weekly chart and we can note that the weekly candle is a very miserly one, with minimal range! So, what looked like a change in trend to some is not even a blip on the bigger picture.

Now, we very well know that we cannot tell the market what it should do. All we can do is take in what it does and examine that evidence from different angles to take a view on what it may do next. That’s it. There is nothing more, unfortunately.

Those that have their nose too close to the monitor screen, will see the intraday part of the chart above and it will appear very much enlarged to them and give them a sense that everything is over and that this so-called breakout was all a sham or a failure.

Maintain a bit of distance and then you see what the market is really doing- just taking a pause. Not by itself anything out of the ordinary. How do we ascertain that this is the case?

Well, we can take a look at the charts of all other sector and other indices to check whether any other pattern was visible. And the answer to that is a clearcut No. Every other index wore a similar looking picture with minimal moves down, attesting to the fact that there was no broad based to decline or participation in the mild weakness as exhibited by the main indices. Thus, we are assured of the fact that the market is just taking a breather and that the solid breakout move of two weeks ago is very much in with a chance of producing more positive moves ahead.

There were pockets of new interest in a couple of areas such as Pharma and Cement. Other sectors like Oil and Gas, Consumer Durables , Healthcare too managed to put up some show of bullishness. Chart 2 shows an ersatz Cement index that I have rigged up. You can note in the chart that the stocks here sought to continue the uptrend and managed to eke out some show of strength. There is evidently new money flowing into this sector and hence investors should take note of this.

The simple rule of the market is, “Go where the market wants to go, not where you want it to go.” This is true whether you are trading or investing.

Among the weaker points in the market in the last week were Realty and Power. This is a bit surprising considering that one has been rallying decently (Realty) while the other (Power) has lots of believers. Perhaps the rally in Realty may be about to see a reaction? If so, it will set up price action along those lines.

Remember that I had highlighted the hesitation in the Defense sector index in the last letter or two? Well, that one has still not shown us any kind of price action that it wants to turn down. Not yet. The news flow there has continued to remain positive and that is perhaps still shoring up the trends in that sector- although the number of stocks that are able to stay up are diminishing. This is what I mean by saying that we should also watch out for confirmatory evidence in the form of follow up price action. Like, the Nifty didn’t really want to go down did it? So, it tossed and turned in an area for a while before staging last week’s thrust. Moral of the story is that when the market wants to do something it will tell is with some price evidence. So, if Realty is done with the rally, that will show us some evidence as well.

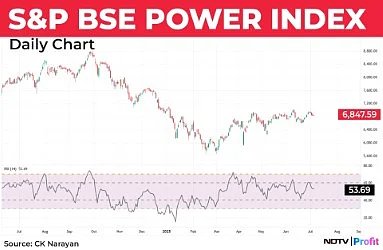

What is intriguing however is that the consensus about Power sector probabilities is not being reflected in the index. See chart 3 that details the Power sector. The decline was in line with the rest of the market but the recovery thereafter has been very anemic. This only signals that very little of the new money coming to the market is going into the Power sector stocks.

If the results of power companies in the upcoming Q1 results are not up to mark (it appears that the market is not expecting anything) then it may be better to exit some of them. Only some surprises can be the exception here.

A matter of interest in the last week was Sebi’s orders on Jane Street, a firm out of the US engaged in high speed algos. They are accused of manipulation of the markets, a charge that may be difficult to prove and may also be challenged by them with SAT. But one of the fallouts of this action by Sebi would be that other such players – whether FII or local- may now think twice about engaging in such activities. To that extent, this is a good move and it may save a lot of suckers in the option markets who were getting regularly slaughtered, almost on a weekly basis. This is a hope and expectation. Let’s see if this happens. If it does, the markets may become more “normal” and create a more normal level playing field for the rest of the retail traders who are hooked on to the options markets. It is notable that this shenanigan has been going on for a while but has been “caught” and acted upon after the change of guard at Sebi! Apparently, it has been a well-known ‘fact’ over the years but it needed someone to act.

When we get into the next week, it will be time for the Q1 results to flow and that may begin localizing the action and lesser attention may be paid to overseas market action. Of course, the Tariffs deadline is set for 9th but there are some indications that India may take some independent line on the same. How (if) that will impact our markets remains to be seen.

Market dipped some from the first turn date of the month (1st) and now the second date is placed for the next week (7-8th) and I am looking for a trend revival to occur from next week. The next one following the upcoming time change date would fall in the last week of July (around 26th). The upside

surge promised a week ago is likely resume after a week’s rest. So, we may have something to look forward to in the week ahead! I have highlighted a couple of sectors where we could see some action too. For those that haven’t got spooked out of the market by last week’s light weakness, patience may be about to get rewarded.

Now, remember, this is yet another expectation from the market. It is entirely up to it whether to oblige us or not. But with price and time coming together, I think it should. Nevertheless a stoploss at 25000 should be maintained for this view. This can be raised once the Nifty futures rises and holds above 25700 in the week ahead.

. Read more on Markets by NDTV Profit.