After the markets extended its decline for the second day on Thursday, charts indicate that the NSE Nifty 50 can see further weakness despite a positive short-term outlook.

A bearish candle on daily charts and a lower-top formation on intraday charts signal further weakness from the current levels, as per Shrikant Chouhan, head of equity research at Kotak Securities.

He added that for day traders, 25,500 are key levels to watch. As long as the market trades below these levels, weak sentiment is likely to continue.

“For any meaningful upside, the index must sustain above 25,500, with the next hurdle placed around 25,600–25,700. On the downside, 25,400 remains immediate support, while 25,300 is a critical level to watch for bulls,” Mandar Bhojane, research analyst at Choice Broking, said.

Key support for the Nifty Bank is placed at 56,000–55,500 region, according to Bajaj Broking.

“Bank Nifty formed a bear candle with a lower high and lower low, signaling continuation of the corrective decline for the second session in a row,” the brokerage added.

Market Recap

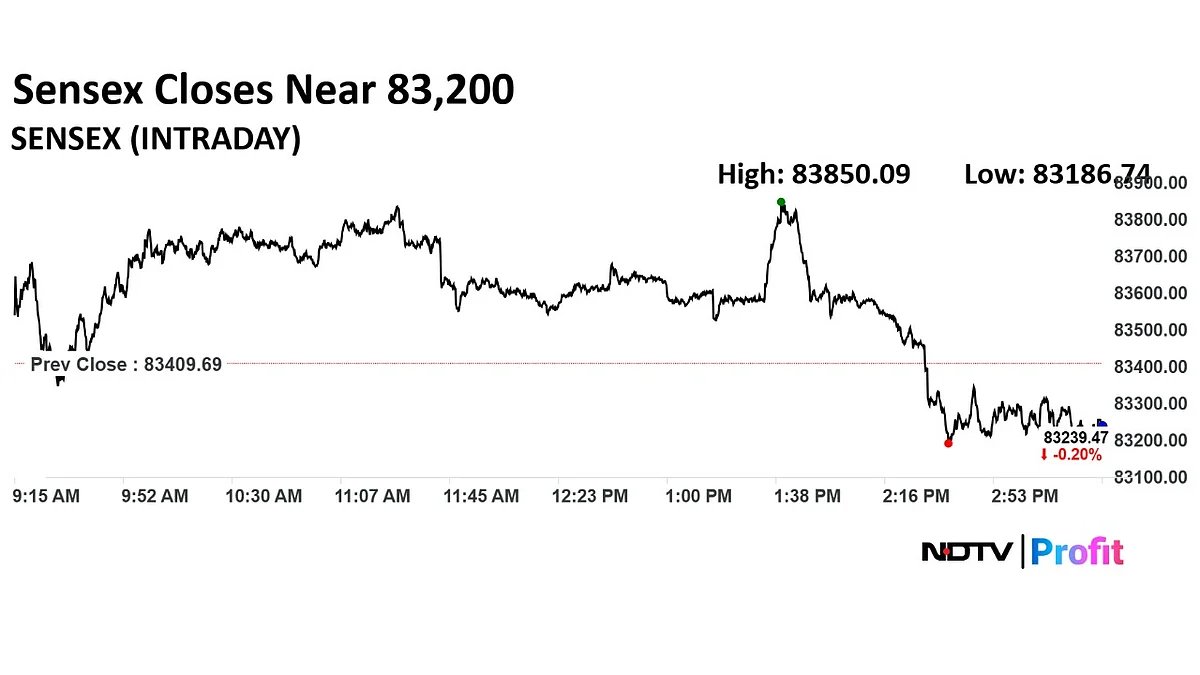

The Indian benchmark equity indices erased the intraday gains to close lower for the second consecutive day on Thursday, dragged by share prices of Kotak Mahindra Bank Ltd. and Bharti Airtel Ltd.

The NSE Nifty 50 ended 48.1 points or 0.19% lower at 25,405.30, while the BSE Sensex closed 170.22 points or 0.2% down at 83,239.47.

Currency Update

The Indian rupee got a boost on Thursday from prospects of an India-US trade deal. The local currency ended 39 paise higher at 85.32, the highest closing since May 26.

Disclaimer: The views and opinions expressed by the investment advisers on NDTV Profit are of their own and not of NDTV Profit. NDTV Profit advises users to consult with their own financial or investment adviser before taking any investment decision.

. Read more on Markets by NDTV Profit.