The shares of this PCB manufacturer are in focus after the company secured an order worth Rs 98 crore from a US firm. In this article, we will discuss more about this in detail.

With a market capitalisation of Rs 1,374 crores, the shares of Aimtron Electronics Ltd are currently trading at Rs 673 per share, down by 7.80 percent from its 52-week high of Rs 729.95 per share. Over the last six months, the stock has delivered a return of 21 percent.

Aimtron, a rapidly growing Electronics System Design and Manufacturing (ESDM) company, has signed an Original Design Manufacturing (ODM) contract worth Rs 97.55 crore with a leading US-based global player in the digital infrastructure and continuity solutions industry.

Under this contract, Aimtron will be fully responsible for designing and manufacturing the next-generation transformer-less Uninterruptible Power Supply (UPS) system, a backup system that keeps electronic devices running during power cuts. This new UPS solution will be compact, energy-efficient, and extremely reliable to protect modern, sensitive electronic equipment.

Financial Highlights

The company reported a revenue of Rs 159 crores in FY25, up by 71 percent from its FY24 revenue of Rs 93 crores. Additionally, the company reported a net profit surge of 85.71 percent to Rs 26 crore in FY25 from Rs 14 crores in FY24.

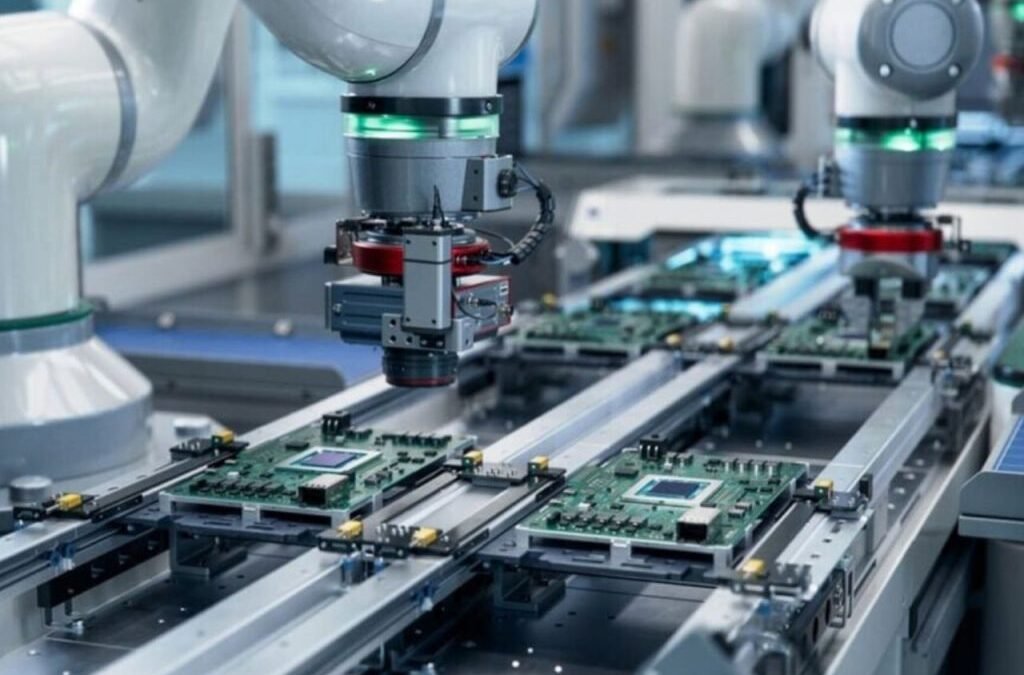

The stock is currently trading at a P/E of 53.40x as compared to its industry average of 37.04x.Aimtron Electronics Limited offers electronics system design and manufacturing (ESDM) services, specializing in high-precision products such as PCB design, assembly, and complete electronic system build. It caters to Indian and international customers, such as the US, UK, Hong Kong, Spain, and Mexico.

Its products find application in healthcare, automotive, gaming, drones, and UAVs. Industrial automation, electric vehicles, IoT, medtech, and robotics are its key domains. The firm operates two manufacturing facilities in Vadodara, Gujarat, and Bengaluru, Karnataka.

Written by Satyajeet Mukherjee

Disclaimer

The views and investment tips expressed by investment experts/broking houses/rating agencies on tradebrains.in are their own, and not that of the website or its management. Investing in equities poses a risk of financial losses. Investors must therefore exercise due caution while investing or trading in stocks. Trade Brains Technologies Private Limited or the author are not liable for any losses caused as a result of the decision based on this article. Please consult your investment advisor before investing.

The post EMS stock skyrockets 11% after receiving ₹98 Cr order for UPS from US based company appeared first on Trade Brains.