Continuing with where we left off over the last two letters, we seem to have achieved the elusive breakout, finally. Here is a continuation chart from the last letter. Chart 1 (intraday NF).

It shows the breakout level mentioned earlier and also a new pitchfork channel that has now been drawn to the prices along with the expected pathway across the coming week. I think we should end up north of 26000 in the week when we shall hit the upper channel. There may be a slight pullback to the median line to gather support once again (on the 1st), followed by another rise to reach the near-term targets by the 7th of July. Likewise, the Bank Nifty should also head toward the 59500-60000 levels as a target.

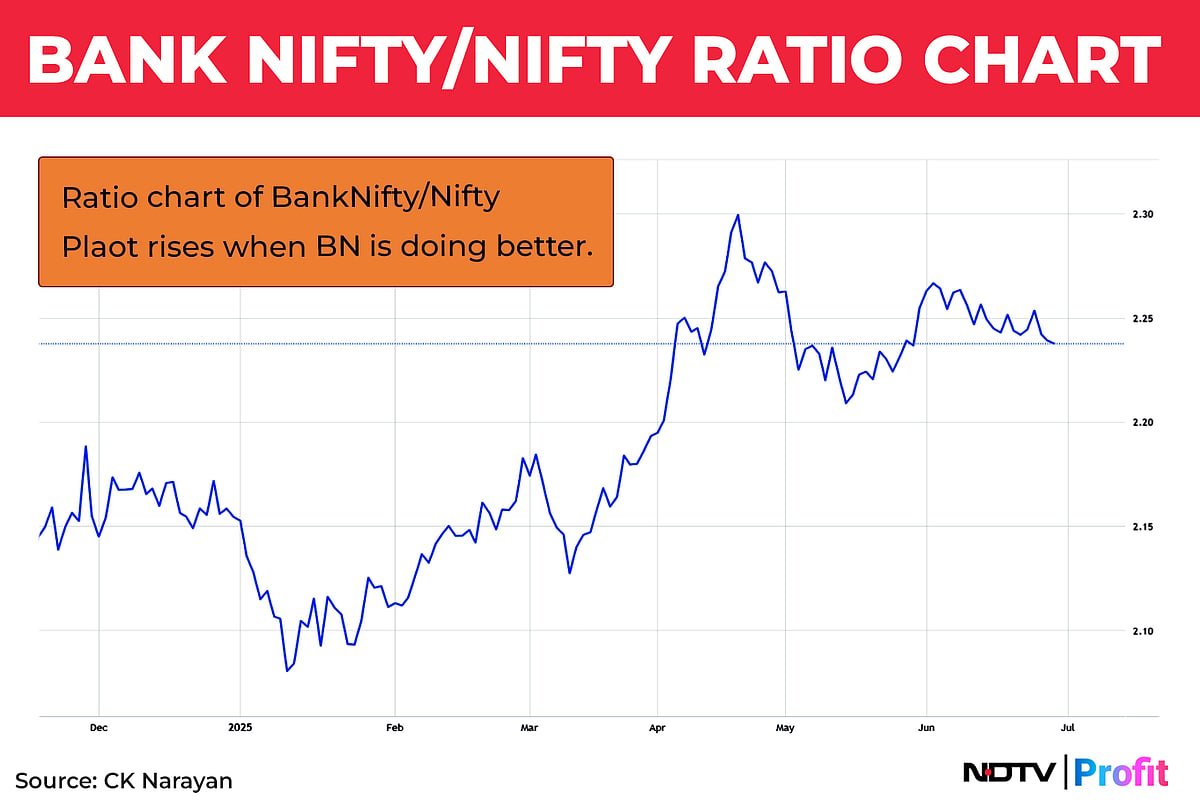

The Bank Nifty has also kept pace with the events, staging an even more decisive breakout, and here it is at all-time highs. In that sense, it is doing better. Chart 2 highlights this.

This is the ratio chart of Bank Nifty vs Nifty, and it is interesting that in recent times this is evenly poised. So, there seems to be a chance for either of them to start moving aggressively, outpacing the other, if they so desire. Given that banks are set to improve (HDFC Bank and ICICI Bank hitting new highs and SBI improving after a CLSA buy report), that ought to contribute nicely to the Nifty itself (owing to the one-third weightage). If, alongside, there are gains in IT and Reliance, then the Nifty itself could get a leg up.

The main point is that the main indices are signalling to us that the coming move of the market is upward and hence that calls for a change in the strategy. With a firmer trend essaying, holding positions for larger gains becomes possible, and so swing and positional trades are back on the table. Just last week I had said that matters were so dicey that we should not be considering them at all – what a difference in a week!

Crude oil settled down as swiftly as it went up owing to the limited warfare in Iran. If that remains steady ahead, we should not be seeing so many painful opening gaps and reversal moves off them, and that enables holding positions overnight if suggested by the charts or news flow. Of course, the last word on this Iran war business is not said yet (e.g., where is the missing uranium?). But for now it seems like both sides are running out of ammo, and the US also got into the act. So some backing off may lead to some extended truce, if not exactly peace. India is comfortable with Brent remaining in this range.

US data suggests that rate cuts there may be back on the table while our expectations for the same also continue to persist. Both of these should help stoke bullish sentiments. Q1 is ending, and in about ten days, we should start rolling with the next quarterly set of numbers. Auto sales will be out next week. Monsoon is rolling out rather well. Our own inflation, etc., seems to be under control. Given all these sanguine circumstances, attention may shift away from global events to local ones, and stocks may come into focus.

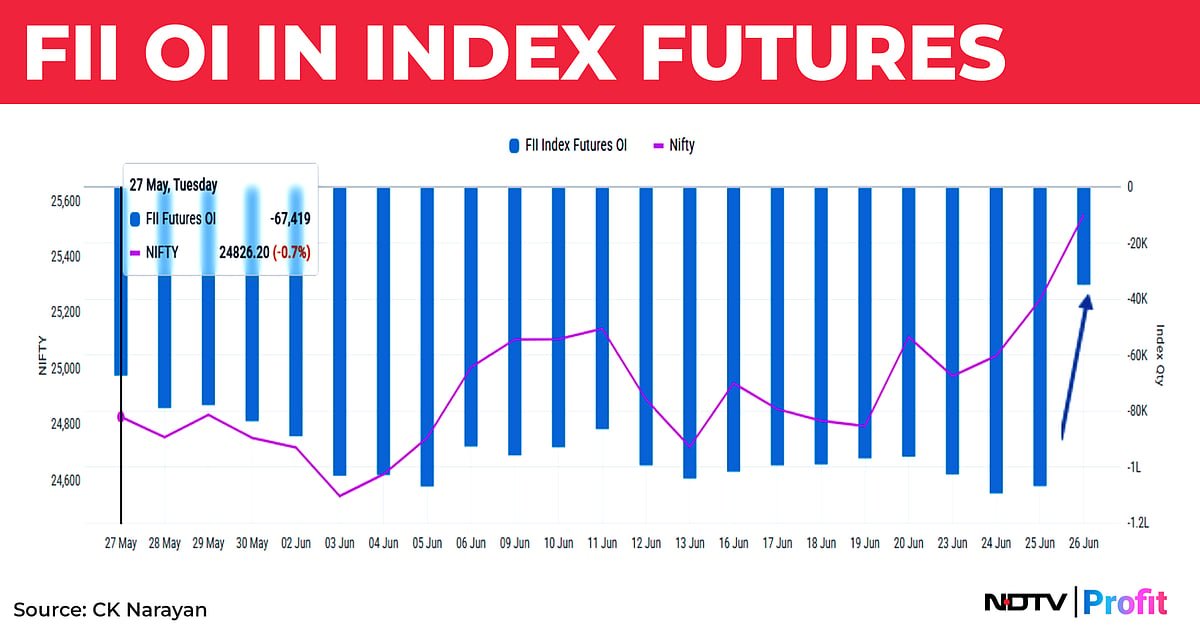

Adding to the good news flow is that the FIIs have cut much of their index short positions on Thursday. Chart 3 shows this. From about 1.10L contracts, they were just 34k contracts now. They have also been buyers in cash this month. Combined, that is enough to create some good cheer in the sentiment.

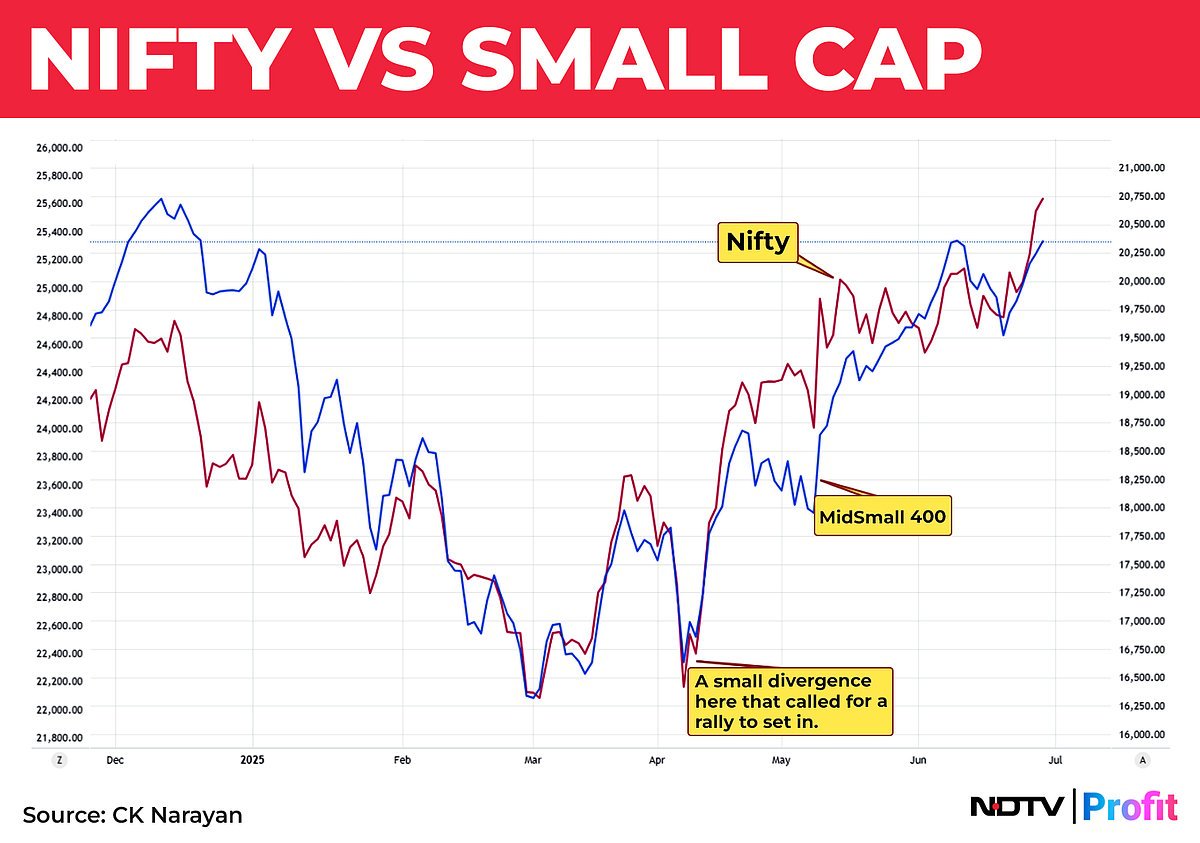

The breakout has led to the bigger indices outperforming the mid- and small-cap space. But the start of a new earnings season will bring the focus back onto those stocks. There is considerable FOMO feeling left in this market. And this generally gets expressed in the small- and midcap space. Chart 4 shows the relative performance of the Nifty vs. the Midsmall 400. Chances are bright that the latter may now play catch-up.

So, we have spoken about the positives. What is it that we don’t want to see ahead?

First up, the declared ceasefire should hold. Any flare-up in engagements this time may have a more serious impact than the previous time. Next, oil needs to remain in a range even if peace does not exactly return to the region. Third, prices should not break back into the prior consolidation zones swiftly, creating a false breakout. That would be very disappointing. Four, FII activity (short cover in index and cash buying) should continue. Etc. You get the idea. The very factors that produced the breakout shouldn’t just fizzle out quickly, in short.

Given that, we should probably see continued upside. A shift in the trading approach has already been outlined earlier. In addition, some preparations can be made for parleying money back into the market based on Q1 results to flow can be made. This is still a mindset thing for many people yet.

. Read more on Markets by NDTV Profit.