Wall Street traders dodged a flurry of tariff headlines to drive stocks to all-time highs, capping a week that saw a cooling in Middle East risks and signs the US economy is holding up amid subdued inflation. A rally in Treasuries stalled. The dollar advanced.

A surge in equities after April’s meltdown drove the S&P 500 to its first record since February, with the gauge topping 6,170. Nvidia Corp. approached $4 trillion. Big banks passed the Federal Reserve’s stress test, setting the stage for payouts. President Donald Trump touted progress on trade deals with a few countries, naming agreements with China and the UK, while saying he was ending talks with Canada. The loonie fell. Oil saw a plunge for the week.

Trump in April put tariffs on dozens of trading partners on pause for three months a week after declaring them, when investors panicked over the possibility of a recession. Following a slide to the edge of a bear market, the S&P 500’s over $10 trillion rally has defied Wall Street expectations, underscoring conviction the economy is withstanding policy uncertainties.

“US equities have continued to recover from the tariff-induced selloff,” said David Lefkowitz at UBS’s Chief Investment Office. “We think the recovery makes sense, considering that most large-cap companies should weather the tariffs reasonably well.”

Treasury Secretary Scott Bessent signaled there may be some extensions to wrap up major pacts by Labor Day. European Commission President Ursula von der Leyen told EU leaders behind closed doors she was confident a deal could be reached before the deadline, according to people familiar with the matter. And China confirmed details of a trade framework with Washington.

On the economic front, consumer sentiment rose sharply to a four-month high and inflation expectations improved notably. Data also showed that while the core personal consumption expenditures price index rose slightly more than expected, the pace was consistent with limited price pressures that will allow the Fed to resume rate cuts later this year.

“A window of opportunity is more likely to open at one of the final three policy meetings of the year — in September, October or December — when the impact of tariff increases on inflation becomes clearer,” said Gary Schlossberg at Wells Fargo Investment Institute.

Fed Chair Jerome Powell told lawmakers this week that he expects inflation to pick up in June, July and August as tariffs become increasingly reflected in consumer prices, though he added if that prediction fails to materialize, the central bank could resume rate reductions sooner rather than later.

Money markets continued to project at least two Fed cuts by the end of this year. Wagers on a third reduction could gain momentum if next Thursday’s jobs report is weak.

To Bret Kenwell at eToro, the latest PCE reading showed that inflation is still not spiraling out of control. However, it did snap a three-month streak of lower year-over-year readings, while last month’s figures were revised higher.

“Today’s inflation report shouldn’t be enough to give markets a significant scare, but it probably dashes the slim hopes investors had for a July rate cut,” Kenwell said. “Further, it may give investors a bit of hesitation with stocks surging into record high territory as we near quarter-end.”

Kenwell says that stocks can do pretty well in a mild-inflationary environment.

“The key will be a reassuring earnings cycle and a strong consumer as we go into the second half of the year,” he noted.

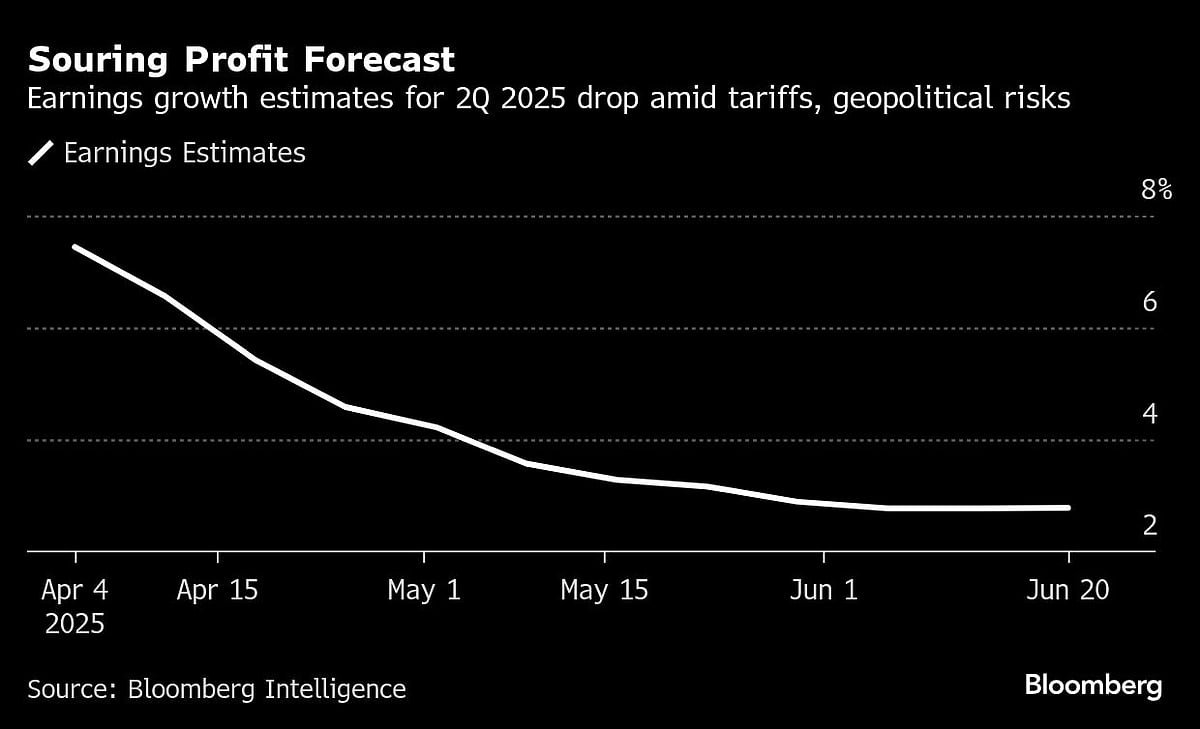

Indeed, with earnings season just weeks away, stocks will get a major test. Wall Street sees profit growth of 2.8% year-over-year for the second quarter for the benchmark, according to data compiled by Bloomberg Intelligence. That would be the smallest jump in two years. The lackluster forecasts magnify concerns from some market watchers that valuations are stretched.

The risk of a speculative stock bubble is increasing as bets on rate cuts draw massive investment flows, according to Bank of America Corp.’s Michael Hartnett. Already this year, $164 billion has flowed into US equities, on course for the third-largest annual inflow in history, he said, citing data from EPFR Global.

Corporate Highlights:

-

Nike Inc. said its yearlong sales decline is starting to ease, suggesting that Chief Executive Officer Elliott Hill’s strategic moves are paying off.

-

Apple Inc. and Google’s Android have been warned by a top German privacy regulator that the Chinese AI service DeepSeek, available on their app stores, constitutes illegal content because it exposes users’ data to Chinese authorities.

-

JPMorgan Chase & Co. shares have soared from an April low on a grab bag of positive developments, but to Baird analysts that’s too far, too fast. They downgraded the lender to underperform from a neutral rating.

-

Shares of Boeing Co. are set to make gains as the company speeds up production of commercial aircraft and takes steps to move on from a series of crises in recent years, according to Rothschild & Co. Redburn, which raised the recommendation on the shares to buy.

-

B. Riley Financial Inc. has sold its financial advisory services business GlassRatner to Canadian private equity firm TorQuest Partners, adding to a series of asset sales as the financial services firm deals with its woes.

-

Alibaba Group Holding Ltd. unveiled a new iteration of its artificial-intelligence technology that will make it easier for users to generate and modify images from texts and visuals, as the Chinese e-commerce giant continues its aggressive push into AI.

Some of the main moves in markets:

Stocks

-

The S&P 500 rose 0.5% as of 4 p.m. New York time

-

The Nasdaq 100 rose 0.4%

-

The Dow Jones Industrial Average rose 1%

-

The MSCI World Index rose 0.6%

-

Bloomberg Magnificent 7 Total Return Index rose 1.1%

-

The Russell 2000 Index was little changed

Currencies

-

The Bloomberg Dollar Spot Index rose 0.1%

-

The euro was little changed at $1.1709

-

The British pound fell 0.1% to $1.3709

-

The Japanese yen fell 0.2% to 144.72 per dollar

Cryptocurrencies

-

Bitcoin fell 0.8% to $106,926.43

-

Ether fell 1.2% to $2,416.73

Bonds

-

The yield on 10-year Treasuries advanced three basis points to 4.27%

-

Germany’s 10-year yield advanced two basis points to 2.59%

-

Britain’s 10-year yield advanced three basis points to 4.50%

Commodities

-

West Texas Intermediate crude fell 0.1% to $65.15 a barrel

-

Spot gold fell 1.7% to $3,270.92 an ounce

. Read more on Markets by NDTV Profit.