The shares of this leading financial services with its tie-up with BlackRock, announced that its JV has received the Securities & Exchange Board of India’s (SEBI) approval to act as a stockbroker. In this article, we will discuss more about this in detail.

With a market capitalisation of Rs 2,05,529 crores, the shares of Jio Financial Services Ltd are currently trading at Rs 324 per share, down by 10 percent from its 52-week high of Rs 363 per share. In the last one year, the stock has delivered a negative return of 8.33 percent.

On Friday, the company, through a stock exchange filing, announced that Jio BlackRock Broking Pvt Ltd, which is a wholly owned subsidiary of Jio BlackRock Investment Advisors, has received regulatory approval from the Securities and Exchange Board of India (SEBI) to start its operation as a brokerage firm in India.

The broking entity’s parent company, JioBlackRock Investment Advisers, is a 50:50 joint venture between Jio Financial Services Limited and BlackRock Inc. With BlackRock, the company plans to revolutionise the way by bringing affordable, transparent, and technology-driven execution capabilities for Indian investors

Financial Highlights

The company reported a revenue growth of 10.13 percent to Rs 2,043 crores in FY25 from Rs 1,855 crores in FY24. It also posted a marginal net profit growth of 0.50 percent, with profits rising to Rs 1,613 crores in FY25 from Rs 1,605 crores in FY24.

Its Asset Under Management rose by 5,710 percent YoY to Rs 10,053 crores in March 2025 from just Rs 173 crores in March 2024. This exponential growth was driven by JioFinance Limited (JFL), which ramped up lending and leasing operations while expanding its footprint to 10 tier-1 cities.

Jio Financial Services Limited provides financial services across India via its subsidiaries. Its core offerings are investing and financing, insurance broking, payment banking, and digital payment services.

The company provides the JioFinance App, which offers UPI transactions, bill payments, insurance advisory, and digital banking among other services. It also provides consumer, corporate, and MSME lending, asset management, and leasing devices via a Device-as-a-Service scheme. It also sells life, health, and general insurance products.

Written by Satyajeet Mukherjee

Disclaimer

The views and investment tips expressed by investment experts/broking houses/rating agencies on tradebrains.in are their own, and not that of the website or its management. Investing in equities poses a risk of financial losses. Investors must therefore exercise due caution while investing or trading in stocks. Trade Brains Technologies Private Limited or the author are not liable for any losses caused as a result of the decision based on this article. Please consult your investment advisor before investing.

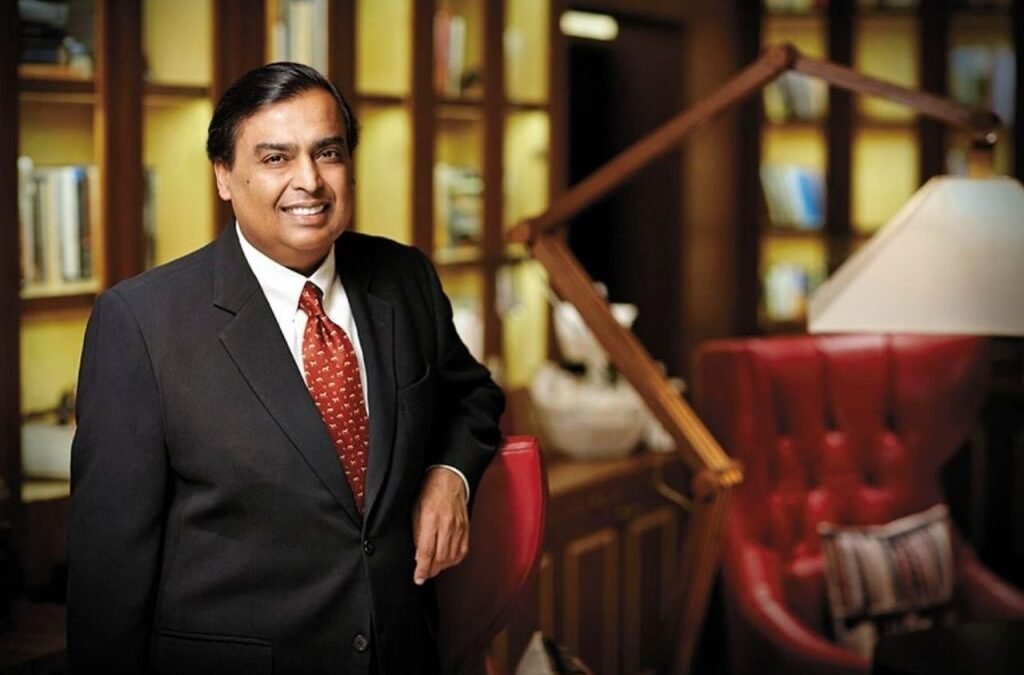

The post Mukesh Ambani stock jumps 5% after receiving regulatory approval from SEBI for its brokerage firm appeared first on Trade Brains.