Union Bank of India Ltd.’s share price rose nearly 2% following the announcement of a fundraising plan. On Wednesday, the bank’s board of directors approved a plan to raise up to Rs 6,000 crore through a combination of debt and equity in the current financial year.

The public sector bank intends to raise up to Rs 3,000 crore through various methods, including further public offers, rights issues, private placements, qualified institutional placements, preferential allotments, or a combination of these options.

Additionally, Union Bank of India plans to issue Basel III-compliant Additional Tier 1 bonds worth up to Rs 2,000 crore and Tier 2 bonds worth up to Rs 1,000 crore, which may include foreign currency-denominated bonds. This capital-raising initiative is subject to government approval.

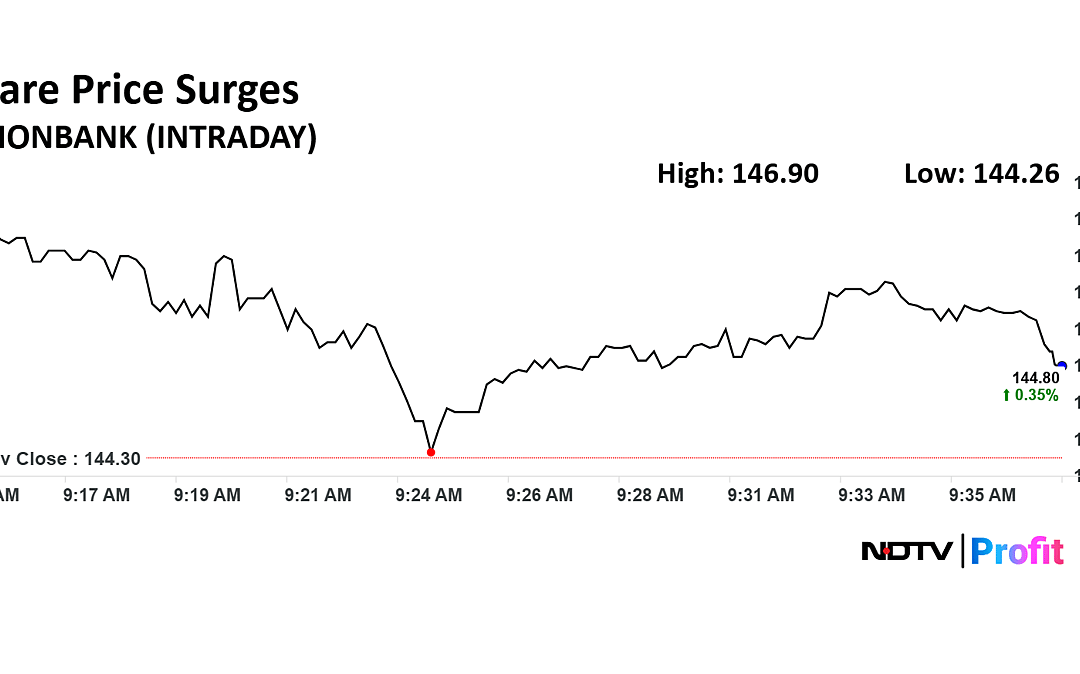

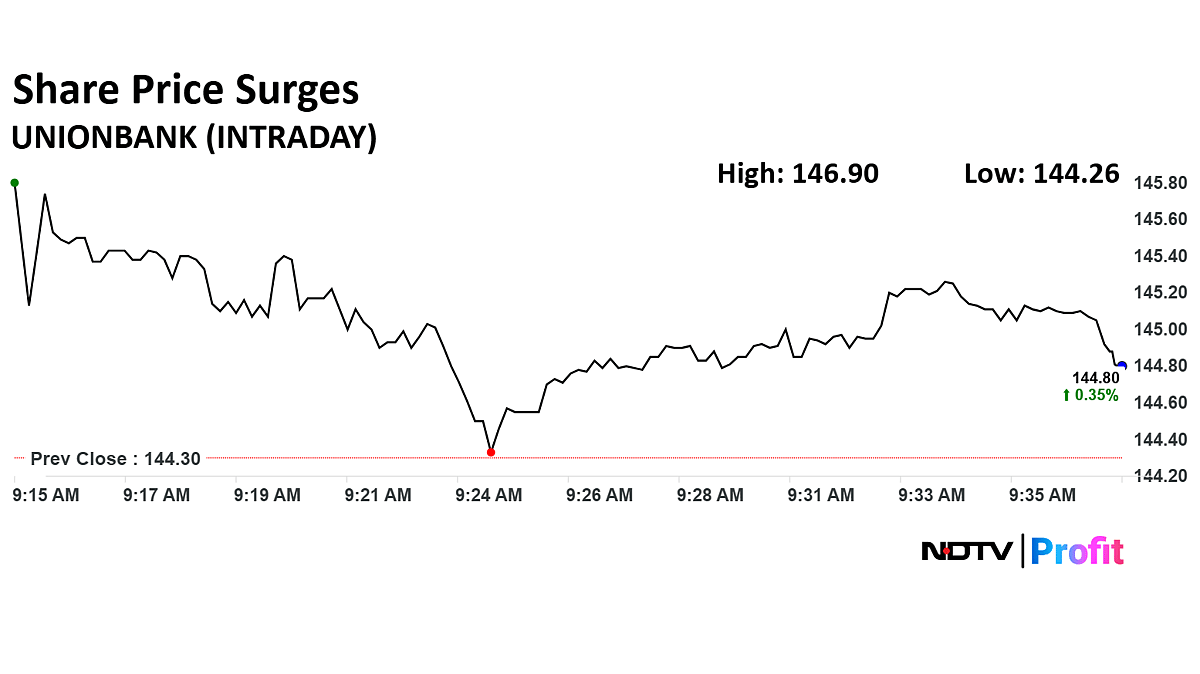

Union Bank Share Price Today

The scrip rose as much as 1.80% to Rs 146.90 apiece. It pared gains to trade 0.46% higher at Rs 144.96 apiece, as of 09:32 a.m. This compares to a 0.53% advance in the NSE Nifty 50.

It has risen 3.20% in the last 12 months. Total traded volume so far in the day stood at 0.10 times its 30-day average. The relative strength index was at 51.

Out of 12 analysts tracking the company, nine maintain a ‘buy’ rating, one recommends a ‘hold’ and two suggest ‘sell’, according to Bloomberg data. The average 12-month consensus price target implies an upside of 4%.

. Read more on Markets by NDTV Profit.