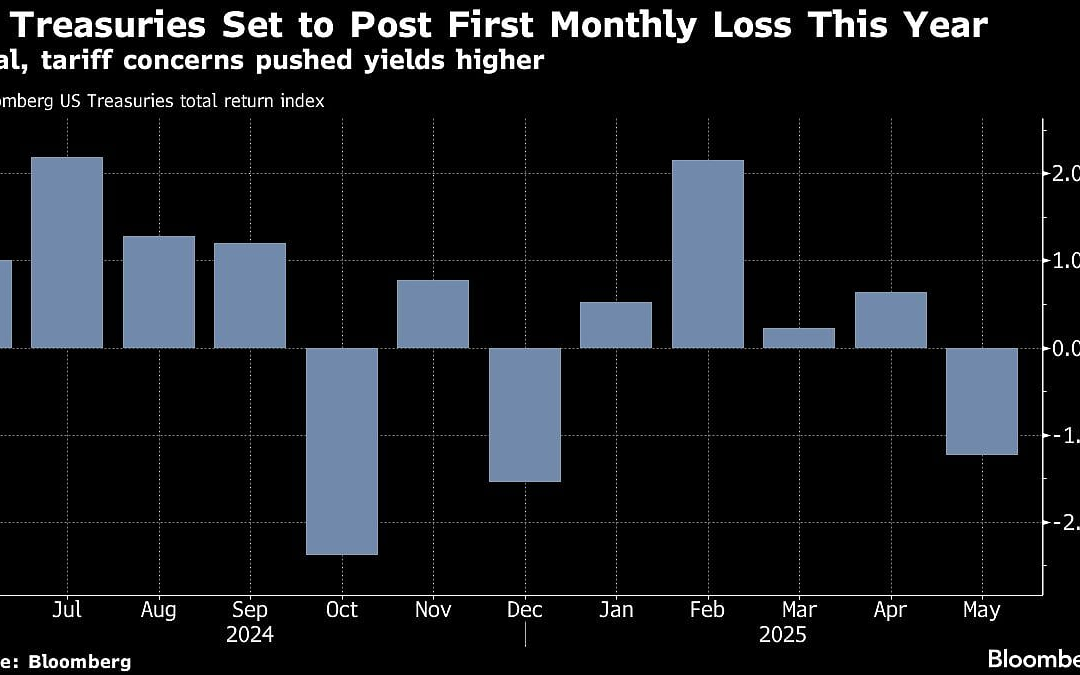

US Treasuries are on track to deliver their first monthly loss this year, buffeted by renewed tariff uncertainty and growing anxiety over mounting levels of government debt.

A Bloomberg index that tracks the bonds is down more than 1.2% in May after all maturities came under pressure. The 30-year yield rose for a third consecutive month, its longest losing streak since 2023, while yields on two- and 10-year tenors posted their first monthly increase this year.

The poor monthly performance reflects the growing headwinds Treasuries face as the US administration’s unpredictable policies shake investor confidence. May saw a resurgence in worries over the US budget deficit as Donald Trump wrestles with Congress over a bill that promises to cut taxes.

“I don’t think there’s a dislocation in bond markets, but you do need to price for the deficit,” said Timothy Graf, head of EMEA macro strategy at State Street Markets in London. “We do still see 5% on 10 notes as the target here.”

On Friday, however, Treasuries rose after Trump in a social media post said China violated an agreement to scale back tit-for-tat tariffs with the US.

The moves held after data showed US imports fell in April, while consumer spending growth slowed and inflation remained tame. Money markets are pricing about 50 basis points of Federal Reserve interest-rate reductions by December.

Signs the economy is stumbling would support shorter-dated maturities in particular, which are more sensitive to Fed policy. The outlook for long bonds remains challenging, however, particularly given supply of safe assets globally is rising.

Citigroup Inc. strategists including Dirk Willer see the term premium in 10-year US Treasuries — the extra return investors demand to own longer-term debt instead of a series of shorter ones — rising another 50 basis points in the next year as competition for buyers heats up. It rose to a decade-high earlier this month.

Fair-Value Gap

At Man Group, portfolio manager Henry Neville is tracking the gap between where the 10-year yield actually trades versus its theoretical fair value.

While Treasuries’ favored status as a traditional safe haven has kept yields much lower than their fair value, the gap has been shrinking.

It’s averaged 150 basis points since 2020, the lowest spread for any decade since the 1960s, according to Neville’s analysis. Between May 2023 and July 2024, the gap was below 100 basis points for 15 straight months, the longest-ever consecutive run below that threshold.

“Persistent readings below 100 are for me the key tell that the dollar and dollar assets may be losing their luster,” he wrote in a note published Friday.

As waning demand from international investors forces domestic buyers to soak up more of the supply, it’s “not difficult” to imagine 30-year yields at 6%, or even higher, said Mark Dowding, chief investment officer at RBC BlueBay Asset Management.

He says positioning for steeper curves — where long-dated bonds underperform shorter ones — may act as a better risk-off hedge than simply betting on lower yields.

. Read more on Markets by NDTV Profit.