U.S. stock futures rose on Friday after closing lower on Thursday. Futures of all the major benchmark indices were positive.

Wall Street is waiting for the fourth-quarter GDP data, scheduled for release later today, along with the Federal Reserve’s preferred inflation gauge, the Personal Consumption Expenditure Price Index.

Meanwhile, President Donald Trump on Thursday warned Iran it must strike a deal on its nuclear program within 10 to 15 days or face “really bad things,” prompting Tehran to threaten retaliation against U.S. bases across the Middle East if it is attacked.

The 10-year Treasury bond yielded 4.07%, and the two-year bond was at 3.47%. The CME Group’s FedWatch tool‘s projections show markets pricing a 94% likelihood of the Federal Reserve leaving the current interest rates unchanged in March.

| Index | Performance (+/-) |

| Dow Jones | 0.26% |

| S&P 500 | 0.37% |

| Nasdaq 100 | 0.47% |

| Russell 2000 | 0.34% |

The SPDR S&P 500 ETF Trust (NYSE:SPY) and Invesco QQQ Trust ETF (NASDAQ:QQQ), which track the S&P 500 index and Nasdaq 100 index, respectively, were higher in premarket on Friday. The SPY was up 0.41% at $687.26, while the QQQ advanced 0.50% to $606.50.

Stocks In Focus

Dropbox

- Dropbox Inc. (NASDAQ:DBX) fell 4.16% in premarket on Friday despite posting better-than-expected fourth-quarter earnings. The company also said it sees FY2026 sales of $2.485 billion to $2.500 billion, versus market estimates of $2.494 billion.

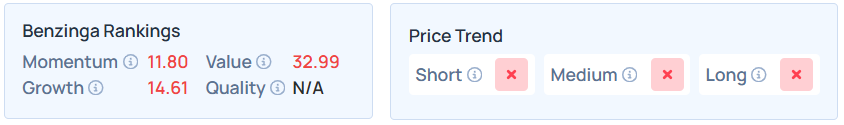

- DBX maintains a weaker price trend over the long, short, and medium terms, with a poor growth ranking, as per Benzinga’s Edge Stock Rankings.