U.S. stock futures were higher on Tuesday following Monday’s positive close. Futures of major benchmark indices were higher.

Gold and Silver staged a rebound from Monday’s low; however, Bitcoin (CRYPTO: BTC) was still trading below the $80,000 per coin mark.

Meanwhile, the federal government entered a partial shutdown Saturday, which will affect the release of economic data from the Bureau of Labor Statistics (BLS). The House is set to vote on a crucial funding bill on Tuesday, but the bill’s passage remains uncertain due to a lack of support from both Democrats and some Republicans.

Additionally, on Monday, President Donald Trump announced a major U.S.–India trade agreement with Prime Minister Narendra Modi that lowers reciprocal tariffs on the South Asian nation from 25% to 18%.

The 10-year Treasury bond yielded 4.29%, and the two-year bond was at 3.58%. The CME Group’s FedWatch tool‘s projections show markets pricing a 91% likelihood of the Federal Reserve leaving the current interest rates unchanged in March.

| Index | Performance (+/-) |

| Dow Jones | 0.002% |

| S&P 500 | 0.20% |

| Nasdaq 100 | 0.48% |

| Russell 2000 | 0.05% |

The SPDR S&P 500 ETF Trust (NYSE:SPY) and Invesco QQQ Trust ETF (NASDAQ:QQQ), which track the S&P 500 index and Nasdaq 100 index, respectively, were higher in premarket on Tuesday. The SPY was up 0.18% at $696.69, while the QQQ advanced 0.47% to $629.07.

Stocks In Focus

Palantir Technologies

- Palantir Technologies Inc. (NASDAQ:PLTR) jumped 10.84% in premarket on Tuesday after reporting better-than-expected fourth-quarter financial results and issuing FY26 sales guidance above estimates.

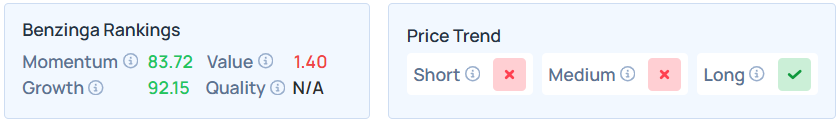

- PLTR maintains a stronger price trend over the long term but a weak trend in the short and medium terms, with a solid growth ranking, as per Benzinga’s Edge Stock Rankings.