U.S. stock futures fell on Tuesday following Friday’s declines. Futures of major benchmark indices were lower.

The stocks extended the negative momentum seen during the holiday break as President Donald Trump‘s threat to impose escalating tariffs on Europe over the Greenland dispute continued to roil global markets.

Meanwhile, the 10-year Treasury bond yielded 4.28%, and the two-year bond was at 3.57%. The CME Group’s FedWatch tool‘s projections show markets pricing a 95% likelihood of the Federal Reserve leaving the current interest rates unchanged in January.

| Index | Performance (+/-) |

| Dow Jones | -1.66% |

| S&P 500 | -1.79% |

| Nasdaq 100 | -2.23% |

| Russell 2000 | -2.17% |

The SPDR S&P 500 ETF Trust (NYSE:SPY) and Invesco QQQ Trust ETF (NASDAQ:QQQ), which track the S&P 500 index and Nasdaq 100 index, respectively, were lower in premarket on Tuesday. The SPY was down 1.70% at $679.90, while the QQQ declined 2.08% to $608.15.

Stocks In Focus

BHP Group

- BHP Group Ltd. (NYSE:BHP) was 1.65% lower in premarket on Tuesday despite lifting copper production guidance after setting new operational records in copper and iron ore for the half year ended 31 December 2025.

- Benzinga’s Edge Stock Rankings shows that BHP maintains a weaker price trend over the short, medium, and long term, with a solid quality ranking.

Alibaba Group Holding

- Alibaba Group Holding Ltd. (NYSE:BABA) dropped 2.35% after the Financial Times reported that TikTok owner ByteDance is launching an aggressive challenge to the company’s dominance in China’s cloud market using deep discounts and AI-led tools.

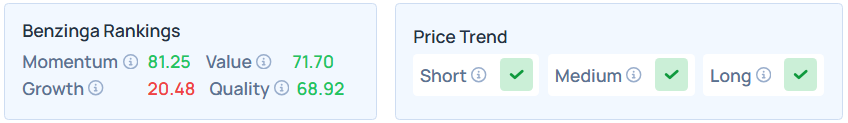

- Benzinga’s Edge Stock Rankings indicate that BABA maintains a strong price trend over short, medium, and long term, with a robust growth ranking.