Synopsis: Vinati Organics is a niche global leader with 65% market share in ATBS & IBB, backed by strong entry barriers, a debt-free balance sheet, and expanding product applications. With capacity expansion, antioxidant scale-up, and new launches, the company is well-positioned for sustainable long-term growth despite near-term volatility.

The recent U.S. announcements of a 26% reciprocal tariff on Indian imports (excluding pharmaceuticals), up from 1.06-3.5%, pose short-term challenges, impacting Indian chemical exporters to a key market. However, India remains competitive versus higher tariffs on China (54%), Vietnam (46%), and Bangladesh (37%), creating opportunities to gain market share with strategic adjustments.

India’s chemical industry is a cornerstone of the nation’s economy, contributing over 9% to manufacturing GVA and nearly 7% of total exports. Ranked sixth globally in chemical production and 14th in exports, India offers a vast portfolio of more than 80,000 products. It holds strong global positions in key segments, second in dyes, third in polymer consumption, and fourth in agrochemicals.

The industry’s growth outlook remains robust. Valued at about US$ 220 billion in 2024, it is projected to reach US$ 300 billion by 2025 and around US$ 383 billion by 2030. Domestic demand is a major driver, with nearly 70% of production consumed locally. Looking ahead, India is expected to account for nearly 20% of the world’s incremental chemical demand by 2040, with domestic consumption projected to surge to approximately US$ 850-1,000 billion.

India Speciality Chemical

India’s speciality chemicals sector is rapidly emerging as a significant player in the global chemical landscape. Growing at a strong 12.2% annually between 2019 and 2024, the sector is expected to reach around US$ 64 billion by 2025. Speciality chemicals already account for more than half of India’s chemical exports, underlining the country’s growing relevance in global value chains. This growth is being fuelled by rising domestic demand, expanding exports, and increased import substitution, with key segments such as agrochemicals, dyes and pigments, and flavours and fragrances leading the way. Supported by initiatives like the National Logistics Policy, Gati Shakti, and Sagarmala, along with efforts to cut import dependence, India is emerging as a preferred hub for manufacturing value-added and specialised chemical products.

About Vinati Organics Ltd:

Established in 1989 as a single-product company, Vinati Organics has evolved into a leading player in speciality chemicals and organic intermediates, with a portfolio of over 30 products. Operating four state-of-the-art manufacturing facilities in Mahad and Lote, the company serves niche global markets with a broad and specialized product range. Vinati exports to more than 40 countries, supplying major industrial and chemical companies across the US, Europe, and Asia. Supported by robust R&D capabilities, Vinati delivers reliable and cost-efficient solutions while maintaining leadership in high-value segments

Product Portfolio:

- Speciality Aromatics: Chemical intermediates that help enhance performance and stability in pharmaceuticals, flavours, food additives, fragrances, and cosmetic additives. Also vital in construction chemicals, adhesives, agrochemicals, paints, polymers, and surfactants, serving industries like textiles, elastomers, lubricants, and industrial gases.

- Speciality Monomers: Basic chemical units that help build polymers with customized physical and chemical properties. Applied in water treatment, paper processing, mineral sequestering, and textile processing. Also used in personal care products, pharmaceuticals, drug delivery, petroleum production, enhanced oil recovery, coating additives, and sensor technologies.

- Butyl Phenols: Aromatic compounds that help improve the performance of resins, coatings, and stabilizers. Essential for agriculture, automotive care, fuel, and fragrance industries. Play a key role in producing plastics, resins, polymerisation inhibitors, spices, antioxidants, molecular weight regulators, and lubricants.

- Miscellaneous Polymers: Specialised polymers that help deliver high resistance, durability, or biodegradability in industrial applications. Specialised for construction, oil drilling, mining, the leather and paper industries, and ceramics, providing enhanced durability, resistance, and biodegradability in demanding industrial applications.

- Antioxidants: Stabilizing compounds that help prevent oxidation and extend the shelf life of materials. Used to safeguard plastics, leather, textiles, and elastomers from oxidation. Also crucial in coatings and adhesives, extending the shelf life and stability of these materials.

- Inhibitors: Prevent polymerization in polymers, pharmaceuticals, and personal care products. Widely applied in adhesives, coatings, and photography to control chemical reactions and maintain product quality.

Competitive Advantages:

- Diverse Industry Applications: Vinati offers specialized chemical solutions for sectors such as agrochemicals, pharmaceuticals, water treatment, personal care, automotive, and textiles.

- Innovation & R&D: Its dedicated R&D team develops advanced products and continually improves processes to boost quality and performance.

- Global Reach: Vinati exports to over 40 countries, partnering with major chemical, petrochemical, and industrial companies worldwide.

- Safety & Compliance: Its manufacturing units follow strict Safety, Health, and Environment (SHE) standards, ensuring high-quality products and timely delivery.

- Competitive Edge: With world-scale production and a fully integrated value chain, Vinati maintains a strong position in the global speciality chemicals market.

- Market Leader: Vinati Organics Ltd holds a dominant 65% global market share in ATBS and IBB, making it the world’s largest producer. It is also India’s largest manufacturer of antioxidants and the only Indian producer of TBA, TB Amine, and Butyl Phenols, reinforcing its leadership in speciality chemicals.

Financial Highlights of Vinati Organics Ltd

| Financial Year | 2020 (Mar) | 2021 (Mar) | 2022 (Mar) | 2023 (Mar) | 2024 (Mar) | 2025 (Mar) | 5-year CAGR |

|---|---|---|---|---|---|---|---|

| Sales (Crores) | 1,029 | 954 | 1,616 | 2,066 | 1,900 | 2,248 | 16.90% |

| Net Profit (Crores) | 334 | 269 | 347 | 419 | 323 | 415 | 4.40% |

| Operating Profit Margin (%) | 40% | 37% | 27% | 28% | 25% | 26% | – |

| Return on Capital Employed (%) | 37% | 24% | 26% | 27% | 19% | 21% | – |

| Earnings per share | 32.5 | 26.2 | 33.7 | 40.8 | 31.2 | 40.1 | 4.30% |

The financial performance of Vinati Organics from FY2020 to FY2025 shows a steady growth trajectory. Sales increased from Rs 1,029 crore in FY2020 to Rs 2,248 crore in FY2025, registering a 5-year CAGR of 16.9%. Net profit, however, grew modestly from Rs 334 crore to Rs 415 crore, with a 5-year CAGR of 4.4%. Operating profit margin declined from a high of 40% in FY2020 to around 26% in FY2025, indicating margin pressure despite higher revenues. Return on Capital Employed also softened, falling from 37% in FY2020 to 21% in FY2025. Earnings per share rose from Rs 32.5 to Rs 40.1 over the period, reflecting moderate improvement in shareholder returns compared to the sharper rise in revenues.

On a consolidated basis, Vinati Organics reported revenue of Rs 550.2 crore in Q2 FY26, largely flat compared to Rs 553.3 crore in Q2 FY25. Despite muted topline growth, profitability improved, with profit before tax rising to Rs 157.3 crore from Rs 133.5 crore, while profit after tax increased by 10.1% YoY to Rs 114.9 crore from Rs 104.4 crore, reflecting better cost efficiency and operating leverage in the quarter. Revenue stability and profit growth were driven by volume-led demand in core products, especially ATBS from oil & gas and water treatment, along with steady growth in butyl phenols and strong traction in antioxidants. Better product mix, operating leverage, cost control, and higher capacity utilisation supported margin expansion and PAT growth despite flat YoY revenue.

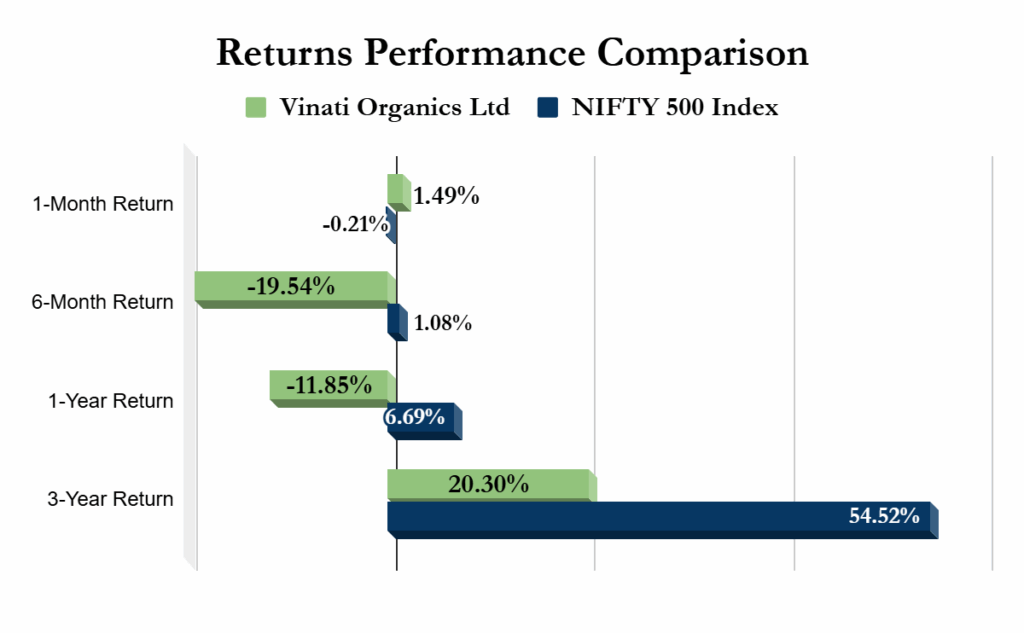

Performance Comparison with Index

A comparison of Vinati Organics Ltd with the NIFTY 500 Index shows underperformance across most time frames. Over the short term, Vinati Organics delivered a positive 1-month return of 1.49%, outperforming the NIFTY 500, which declined by -0.21%. However, in the medium to long term, the stock lagged the broader market, posting a 6-month return of -19.54% and a 1-year return of -11.85%, compared with gains of 1.08% and 6.69% for the NIFTY 500. Over three years, Vinati Organics returned 20.30%, significantly lower than the index’s strong 54.52% return, indicating relative underperformance in long-term wealth creation.

What lies ahead for Vinati Organics?

The management is targeting 20% CAGR in revenue over the next three years while sustaining EBITDA margins of 26-27% over the long term (3-5 years), excluding other income. Growth will be led by the company’s dominant position in ATBS, steady performance in Butyl Phenols, strong scale-up in Antioxidants (AO), and increasing contribution from Veeral Organics Pvt. Ltd. (VOPL). ATBS is expected to deliver double-digit growth in FY26, with global market share holding firm at 60-65% and oil & gas applications rising to 40-45% of demand. Combined revenues from Butyl Phenols and AO are projected at Rs 800-850 crore in FY26, supported by AO capacity utilisation improving from 50% to 90% over two years, alongside the development of a new lubricant antioxidant. Veeral Organics Pvt. Ltd is expected to contribute Rs 100 crore in FY26, with asset turnover exceeding 1:1 at full utilisation of the Rs 500 crore capex.

To support this growth, the company has planned Rs 360 crore capex in FY26, with Rs 300 crore allocated to ATBS expansion. This expansion will be executed in two phases, Phase 1 (25-30% capacity increase) by June 2025, followed by the next phase a year later, taking ATBS capacity from 40,000 to 60,000 tonnes (low molecular) or 30,000 to 50,000 tonnes (high molecular). VOPL will launch multiple new products across Q2-Q3 FY26, including Anisole (backward integration), 4-MAP, TAA, and PTAP. Additionally, the R&D pipeline includes 3-4 new products focused on vertical, downward, and horizontal integration, with successful trials likely to trigger the next phase of capex announcements in the coming quarters.

Competitive analysis:

| Metrics | Vinati Organics Ltd | Clean Science and Technology Limited | IOL Chemicals & Pharmaceuticals Ltd |

|---|---|---|---|

| Market Capitalisation | ₹16,476.00 | ₹9,328.00 | ₹2,420.00 |

| Price-to-Earnings Ratio | 35.4 | 31.7 | 20.8 |

| Book Value | ₹287.00 | ₹146.00 | ₹59.70 |

| Dividend Yield % | 0.47% | 0.68% | 0.97% |

| ROCE | 20.60% | 29.30% | 8.86% |

| ROE | 15.80% | 21.90% | 6.13% |

| Debt-to-Equity Ratio | 0 | 0 | 0.09 |

| Promoter Holdings | 74.29% | 50.96% | 52.62% |

| FII Holdings | 3.77% | 11.14% | 2.25% |

| DII Holdings | 9.55% | 18.97% | 0.05% |

The table highlights Vinati Organics Ltd. as a premium speciality chemicals player positioned between Clean Science and IOL Chemicals in terms of scale, profitability, and valuation. With a market capitalisation of Rs 16,476 crore, Vinati is significantly larger than both peers, reflecting its strong franchise in niche products and consistent execution. While its P/E of 35.4x is higher than Clean Science’s (31.7x) and IOL (20.8x), this premium is supported by healthy returns (ROCE of 20.6% and ROE of 15.8%), a debt-free balance sheet, and leadership in high-entry-barrier chemistries. Dividend yield is lower than peers, indicating a sharper focus on reinvestment-led growth rather than cash payouts.

Compared to peers, Vinati’s promoter holding of 74.29% stands out as the highest, signalling strong promoter confidence and long-term commitment. However, institutional ownership (FII + DII) is relatively lower than Clean Science, suggesting potential headroom for incremental institutional re-rating as growth visibility improves.

Conclusion

Vinati Organics stands out as a rare, high-quality speciality chemical franchise with global leadership in niche products (65% share in ATBS & IBB), strong entry barriers, and a debt-free balance sheet. While recent stock performance has lagged broader indices and margins have normalized from peak levels, the core business fundamentals remain intact.

The company’s growth visibility is anchored in ATBS capacity expansion, antioxidant scale-up, new product launches, and Veeral Organics’ contribution, supporting management’s 20% revenue CAGR guidance with structurally healthy EBITDA margins of 26–27%. For long-term investors, Vinati offers a compelling blend of market leadership, capital efficiency, and reinvestment-led growth, making it well-positioned to benefit from India’s rising role in global speciality chemicals, albeit with the expectation of moderate near-term volatility and valuation sensitivity.

Disclaimer: The views and investment tips expressed by investment experts/broking houses/rating agencies on tradebrains.in are their own, and not that of the website or its management. Investing in equities poses a risk of financial losses. Investors must therefore exercise due caution while investing or trading in stocks. Trade Brains Technologies Private Limited or the author are not liable for any losses caused as a result of the decision based on this article. Please consult your investment advisor before investing.

The post Why Vinati Organics Could Be a Quiet Winner in India’s Specialty Chemicals Boom appeared first on Trade Brains.