Benchmark indices closed the week that passed on a weaker note, even as select sectors managed to post gains. The rupee softened against the dollar, and foreign investors turned sellers after a brief buying streak. Domestic institutions, however, continued to support the market.

The week ahead will be shaped by key global economic data releases and a lighter US trading schedule. In the domestic market, a mainboard IPO, several SME issues, and a busy lineup of corporate actions are set to keep investors engaged.

Take a look at the line up for the week ahead:

Markets On The Home Turf

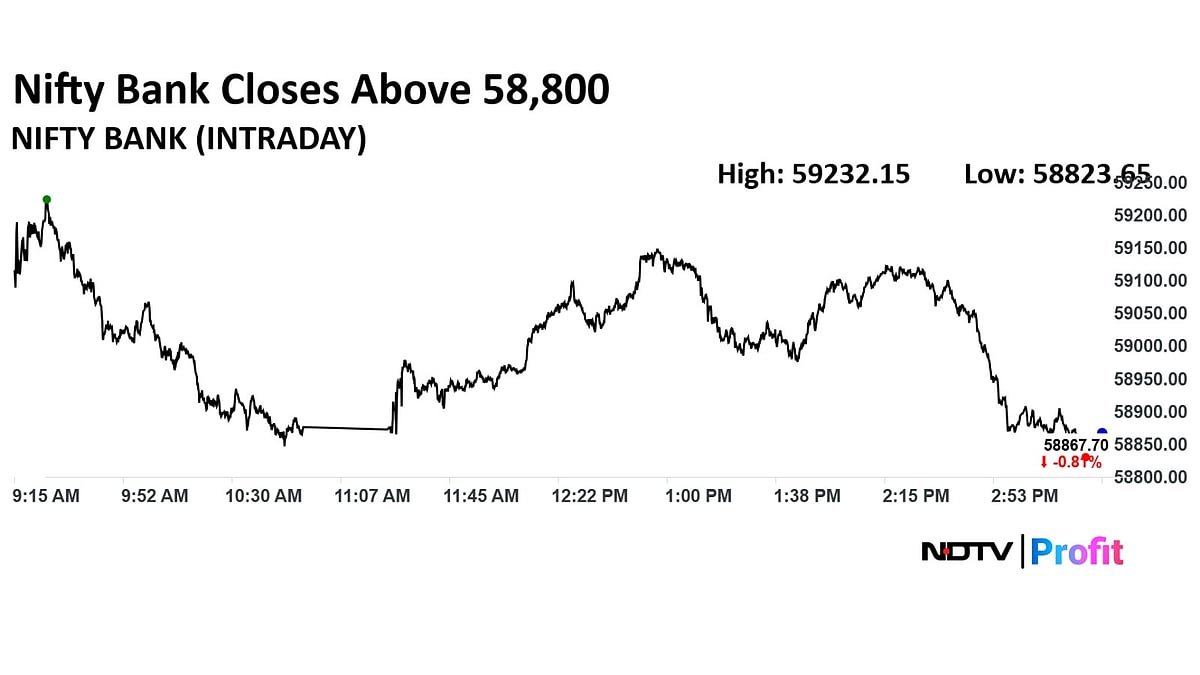

Benchmark indices ended near the day’s lows on Friday, with the Sensex closing 400.76 points, or 0.47%, down at 85,231.92, while the Nifty 50 slipped 124 points, or 0.47%, to 26,068.15.

The rupee posted its sharpest single-day decline in over three months and, for the first time, breached the 89-per-dollar mark, falling 78 paise to 89.46 during Friday’s intra-day trade amid weak global and domestic market cues.

Seven of the 16 major sectoral indices still managed weekly gains. The IT index rose 1.6%, supported by a 2.8% jump in Infosys after its Rs 180-billion share buyback kicked off on Thursday. The auto index added 1.1% for the week, driven by strong quarterly results from Eicher Motors and Hero MotoCorp, which gained 6.6% and 8.4%, respectively.

Foreign portfolio investors turned net sellers on Friday, snapping a four-day buying session, with overseas investors having sold Rs 1,262.22 crore worth of Indian equities, according to provisional data from the National Stock Exchange.

The domestic institutional investors remained net buyers for the 21st straight session, as they mopped up stocks worth Rs 1,757.84 crore.

Global Events To Watch For

Next week, the US economic calendar opens on Tuesday, with Core Retail Sales (MoM) for September alongside PPI (MoM) and Retail Sales (MoM).

On Wednesday, the UK will publish its Autumn Forecast Statement at 05:00. The US will follow with Q3 GDP, and Initial Jobless Claims.

Thursday is a US market holiday for Thanksgiving, and Friday will see an early close at 13:00.

New Players On The D-Street

Sudeep Pharma is the only open mainboard offer in the week ahead. The Sudeep Pharma IPO is a book-building issue of Rs 895 crore. It comprises a fresh issue of 16 lakh shares, aggregating Rs 95 crore, along with an offer-for-sale component of 1.35 crore shares, amounting to Rs 800 crore.

The IPO price band has been fixed at Rs 563 to Rs 593 per share. The lot size consists of 25 shares.

On the SME front, Mother Nutri Foods Ltd. and K K Silk Mills Ltd. will open their issues on 26 November and close on 28 November, while SSMD Agrotech India Ltd. will launch its issue on 25 November and close on 27 November.

Corporate Actions

Altius Telecom Infrastructure Trust will execute its income distribution on Nov. 24. On Nov. 25, Ingersoll-Rand (India) Ltd will pay an interim dividend of Rs 55 per share, while Medinova Diagnostic Services Ltd will carry out its amalgamation.

On Nov. 26, HDFC Asset Management Company Ltd will issue a 1:1 bonus, Power Finance Corporation Ltd will pay an interim dividend of Rs 3.65 per share, and Shyamkamal Investments Ltd will distribute an interim dividend of Rs 0.10 per share.

On Nov. 27, AK Capital Services Ltd will pay an interim dividend of Rs 16 per share.

A series of actions will follow on Nov. 28: Aryavan Enterprise Ltd and Meera Industries Ltd will pay interim dividends of Rs 0.50 each, Nile Ltd will distribute an interim dividend of Rs 5 per share, Thyrocare Technologies Ltd will execute a 2:1 bonus issue, and Unison Metals Ltd will implement a stock split from Rs 10 to Rs 1.

. Read more on Business by NDTV Profit.