Q2 Results Live: Zomato Segment Highlights

-

Food ordering and delivery revenue up 23.5% YoY at 2,485 crore

-

Quick Commerce revenue up 8.5x at 9,891 crore

-

Hyperpure supplies revenue down 30.5% at 1,023 crore

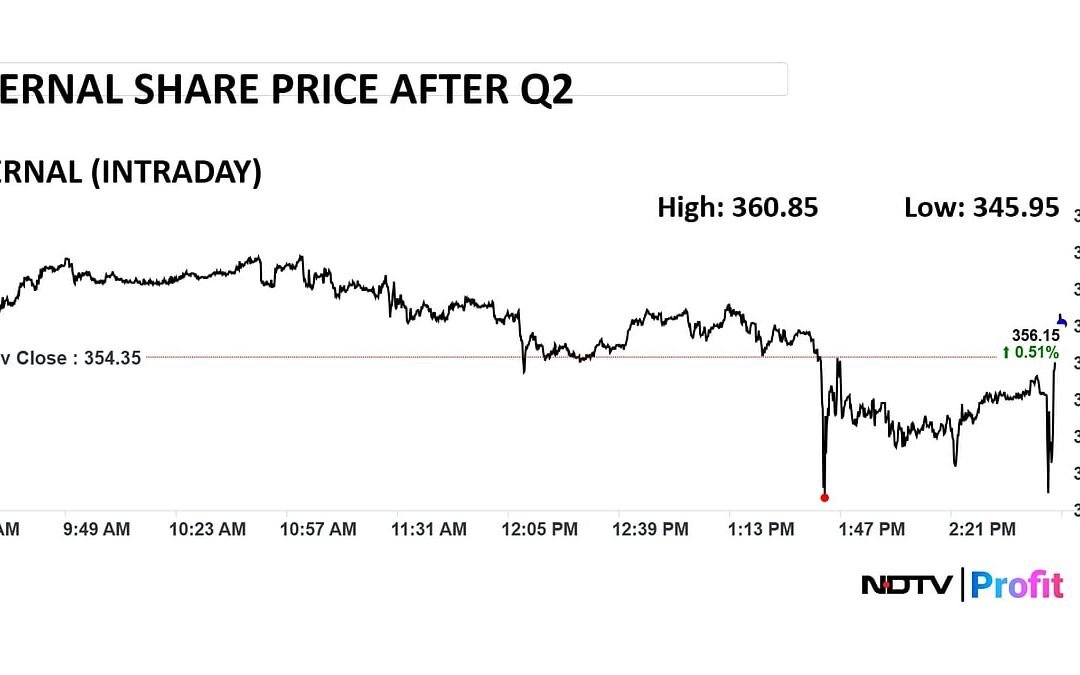

Q2 Results Live: Zomato Shares Wobble

Q2 Results Live: Zomato Revenue Beats Estimates

Eternal Q2FY26 (Consolidated, YoY)

-

Revenue at Rs 13,590 crore versus Rs 4,799 crore (Bloomberg estimate: Rs 8,665 crore)

-

EBITDA up 5.8% at Rs 239 crore versus Rs 226 crore (Estimate: Rs 236 crore)

-

Margin at 1.8% versus 4.7% (Estimate: 2.7%)

-

Profit down 63% at Rs 65 crore versus Rs 176 crore (Estimate: Rs 108 crore)

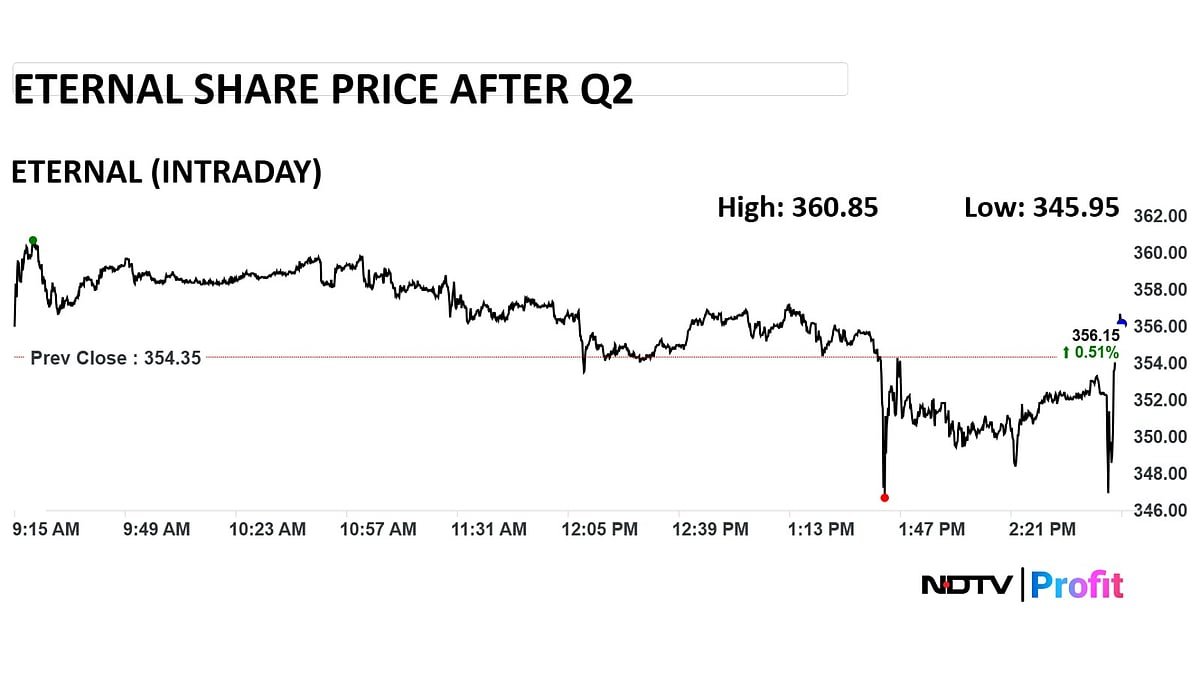

Q2 Results Live: South Indian Bank NII Falls

South Indian Bank Q2FY26 (Standalone, YoY)

-

Net Interest Income down 8.3% at Rs 809 crore versus Rs 882 crore

-

Net Profit up 8.2% at Rs 351 crore versus Rs 325 crore

-

Operating Profit down 2.7% at Rs 536 crore versus Rs 550 crore

-

Provisions down 42.5% at Rs 63.3 crore versus Rs 110 crore

-

Provisions down 73.5% at Rs 63.3 crore versus Rs 239 crore (QoQ)

-

Gross NPA at 2.93% versus 3.95% (QoQ)

-

Net NPA at 0.56% versus 0.68% (QoQ)

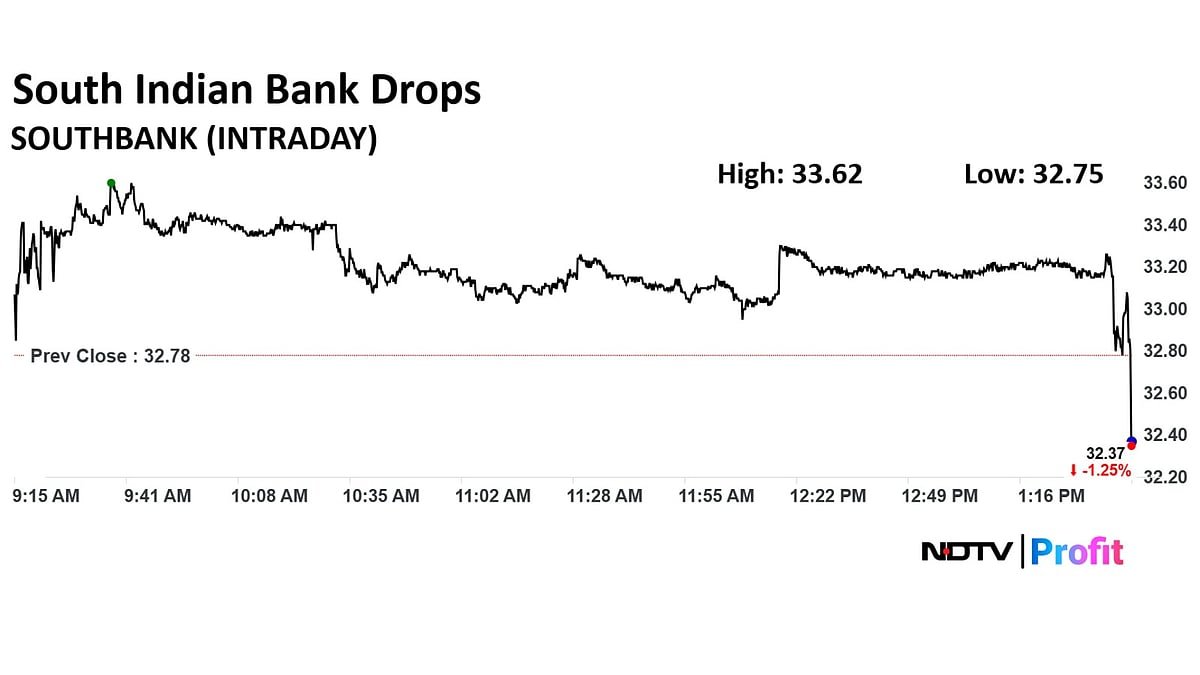

Q2 Results Live: Kajaria Ceramics Dividend

Kajaria Ceramics to pay interim dividend of Rs 8 per share.

Q2 Results Live: Kajaria Ceramics Profit Soars Over 50%

Kajaria Ceramics Q2FY26 (Consolidated, YoY)

-

Revenue up 2.1% at Rs 1,186 crore versus Rs 1,162 crore

-

EBITDA up 30.5% at Rs 214 crore versus Rs 164 crore

-

Margin at 18% versus 14.1%

-

Net Profit up 56.7% at Rs 134 crore versus Rs 85.5 crore

Q2 Results Live: Swaraj Engines Profit, Revenue Rise

Swaraj Engines Q2FY26 (YoY)

-

Revenue up 8.6% at Rs 504 crore versus Rs 464 crore

-

EBITDA up 8.3% at Rs 68 crore versus Rs 62.8 crore

-

Margin flat at 13.5%

-

Net Profit up 9.4% at Rs 49.7 crore versus Rs 45.4 crore

Q2 Results Live: Mastek Profit, Margin Grows

Mastek Q2FY26 (Consolidated, QoQ)

-

Revenue up 2.8% at Rs 940 crore versus Rs 915 crore

-

EBIT up 7.4% at Rs 128 crore versus Rs 119 crore

-

Margin at 13.6% versus 13%

-

Net Profit up 5.9% at Rs 97.5 crore versus Rs 92 crore

Q2 Results Live: Indian Bank Profit Up, Provisions Down

Indian Bank Q2FY26 (Standalone, YoY)

-

Net Profit up 11.5% at Rs 3,018 crore versus Rs 2,706 crore

-

Net Interest Income 5.8% at Rs 6,551 crore versus Rs 6,194 crore

-

Operating Profit up 2.3% at Rs 4,837 crore versus Rs 4,729 crore

-

Provisions down 32.8% at Rs 739 crore versus Rs 1,099 crore

-

Provisions up 7% at Rs 739 crore versus Rs 691 crore (QoQ)

-

Gross NPA at 2.6% versus 3% (QoQ)

-

Net NPA at 0.16% versus 0.18% (QoQ)

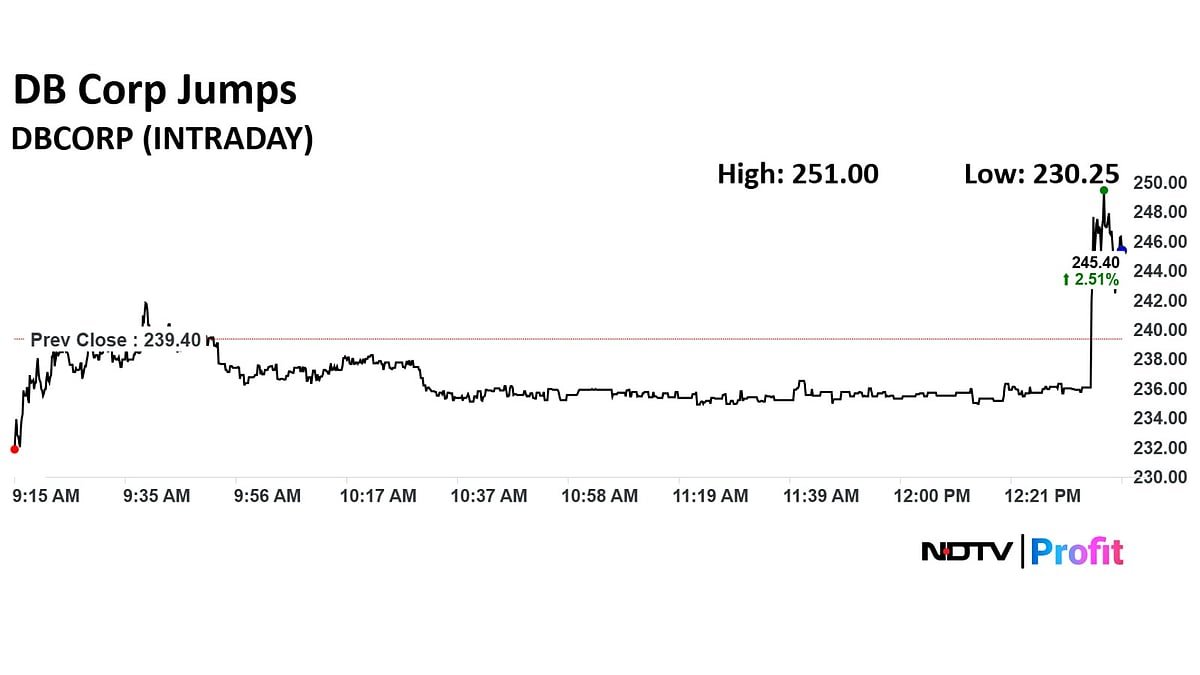

Q2 Results Live: DB Corp Profit Up

DB Corp Highlights Q2FY26 (Consolidated, YoY)

-

Revenue up 9.9% at Rs 614 crore versus Rs 559 crore

-

Ebitda up 14.6% at Rs 138 crore versus Rs 121 crore

-

Margin at 22.5% versus 21.6%

-

Net Profit 13.2% at Rs 93.4 crore versus Rs 82.5 crore

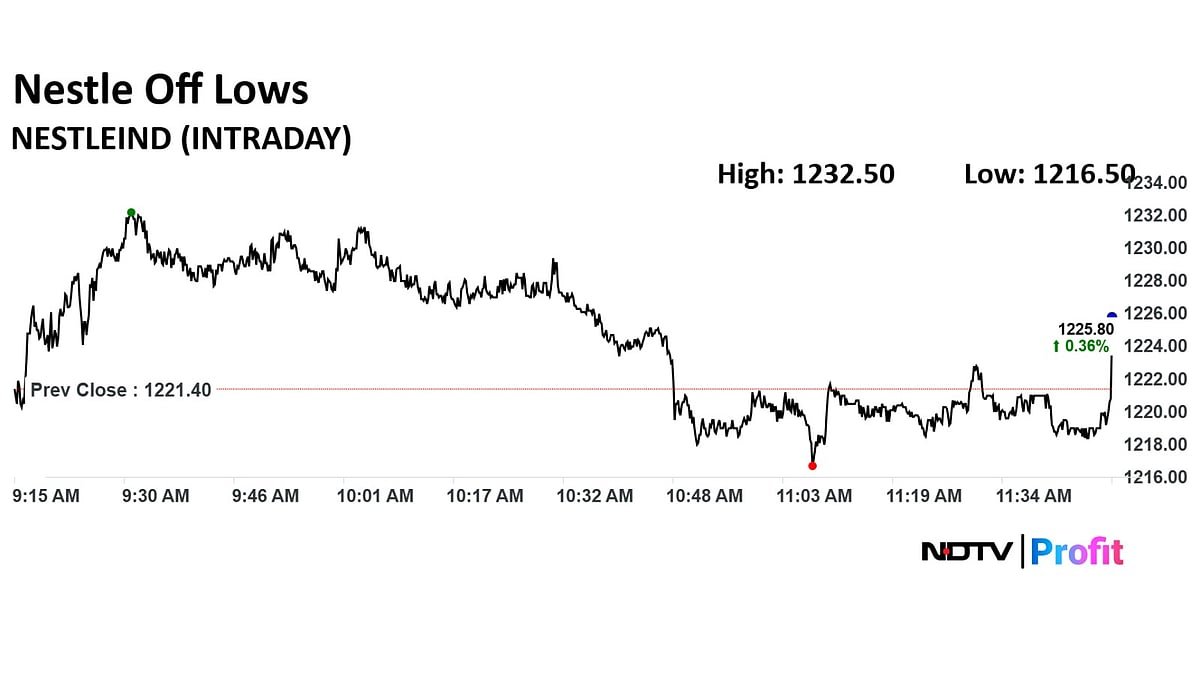

Q2 Results Live: Analyst Commentary On Nestle India

CLSA

-

Strong result with better-than-expected profitability.

-

Stong numbers despite trade disruption for other FMCG incumbents due to GST change.

Morgan Stanley

-

Good surprise on top line and in-line margins.

-

Both domestic sales and exports were ahead of estimates.

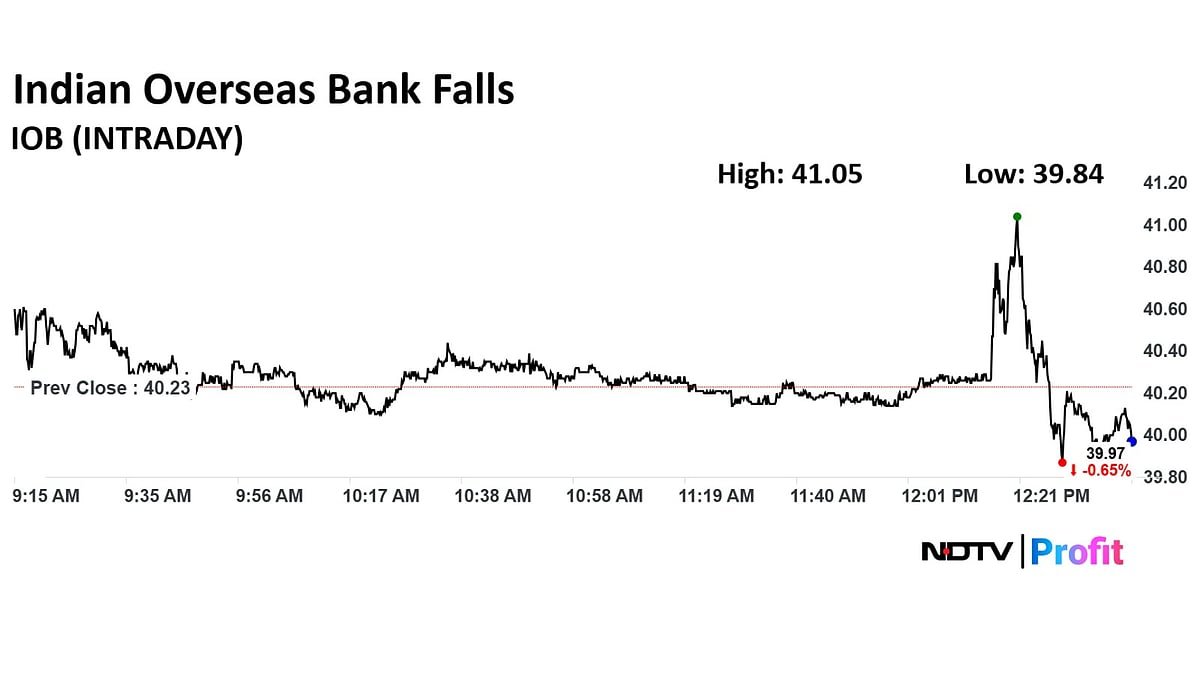

Q2 Results Live: Indian Overseas Bank Shares Down

Q2 Results Live: Indian Overseas Bank Profit Jumps

Indian Overseas Bank Q2FY26 (Standalone, YoY)

-

Net Profit up 57.8% at Rs 1,226 crore versus Rs 777 crore

-

Net Interest Income up 20.6% at Rs 3,059 crore versus Rs 2,537 crore

-

Operating Profit up 12.8% at Rs 2,400 crore versus Rs 2,128 crore

-

Provisions down 41.3% at Rs 672 crore versus Rs 1,146 crore

-

Provisions down 20.3% at Rs 672 crore versus Rs 844 crore (QoQ)

-

Gross NPA at 1.83% versus 1.97% (QoQ)

-

Net NPA at 0.28% versus 0.32% (QoQ)

Q2 Results Live: Nestle India On GST Cut Impact

“The recent amendments in the Goods and Services Tax (GST) rates announced by the Government of India is a positive step for consumers. It is expected to stimulate consumption, drive affordability and contribute to the overall growth of the FMCG sector and the economy. We have been working closely with our partners, distributors, wholesalers, and retailers, to pass on the benefits of the revised GST rates, across our product groups to our consumers.”

Source: Nestle Q2 statement

Q2 Results Live: Nestle India’s Commodity Outlook

-

Milk prices are expected to soften after the festive season, coinciding with the onset of the flush season.

-

Coffee prices are anticipated to stabilize and may decrease as the upcoming crops in Vietnam and India appear to be normal.

-

The global supply and demand for cocoa are projected to balance, primarily due to a correction in demand over the past two years.

-

Edible oil prices are expected to remain firm and may rise further due to a tight supply and demand at the global level.

Q2 Results Live: Nestle India Business Performance

-

Total sales and domestic sales for the quarter increased by 10.9% and 10.8% year-on-year, respectively.

-

Three out of four product groups delivered strong volume, leading to double-digit income growth.

-

Domestic sales reached Rs 5,411 crore, the highest ever recorded in any quarter.

-

The Confectionery, Powdered and Liquid Beverages, Prepared Dishes and Cooking Aids product groups grew at a strong double-digit rate, driven by significant underlying volume growth.

Q2 Results Live: Nestle India Share Price Rises

Q2 Results Live: Nestle India Revenue Beats Estimates

Nestle India Q2FY26 Highlights (Standalone, YoY)

-

Revenue up 10.5% at Rs 5,643 crore versus Rs 5,104 crore (Bloomberg estimate: Rs 5,350 crore)

-

Net profit down 23.7% at Rs 753 crore versus Rs 986 crore (Bloomberg estimate: Rs 762 crore)

-

Ebitda up 6% at Rs 1,237 crore versus Rs 1,168 crore (Bloomberg estimate: Rs 1,191 crore)

-

Margin at 21.9% versus 22.9% (Bloomberg estimate: 23.4%)

-

Note: Exceptional gain of Rs 91 crore in Q2 FY25 on slump sale of two businesses.

Zomato Q2 Results Preview: Margin Likely To Expand

Eternal Ltd., formerly known as Zomato, will report its results for the second quarter of financial year 2026 on Thursday.

Brokerages remain upbeat on Eternal ahead of its September quarter results, citing sustained strength in both food delivery and quick commerce. Most expect the company to post mid-to-high teens growth in food delivery GOV and over 130–140% year-on-year growth in Blinkit’s GOV, driven by continued store expansion, festive demand, and rising user acquisition.

Citi, Kotak Institutional Equities, and Morgan Stanley highlight Blinkit’s strong momentum and improving contribution margins, aided by the shift to the 1P model. JPMorgan and Nuvama forecast steady food delivery margins, with contribution margins expanding by 20 basis points sequentially.

Read full story below:

Nestle India Q2 Results Live: Demand Recovery In Sight, Check Preview

Nestle India Ltd. is set to announce its second quarter results amid a period of steady but moderating growth momentum, with analysts anticipating a mixed performance across key segments.

While demand trends are showing gradual improvement as the urban consumption slowdown eases, margin pressures are likely to persist due to elevated input costs, particularly in coffee and palm oil.

Brokerage estimates suggest modest top-line growth supported by price hikes in premium categories and benefits from recent GST rate cuts, though temporary destocking by trade partners ahead of the tax change may weigh on near-term volumes.

Read full story below:

Infosys Q2 Results Live: Investors Eye Guidance Update

Infosys Ltd. is expected to post a 4% rise in consolidated profit to Rs 7,222 crore for the July–September quarter, according to Bloomberg estimates. Revenue is projected to grow 4% sequentially to Rs 44,008 crore, while Ebit is seen up 6% to Rs 9,338 crore.

Analysts expect a steady quarter with moderate revenue growth and sequential margin expansion, led by stable demand in financial services and large deal ramp-ups. The focus will be on management commentary on FY26 guidance, client budgets, and discretionary spending trends.

Infosys’ results will be closely tracked for its FY26 growth guidance and commentary on discretionary technology spending, especially in financial services and European markets. Analysts expect margins to remain within the guided band, supported by operational discipline and deal execution.

Read full story below:

Wipro Q2 Results Live: Margin Seen Steady; Check Preview

Wipro is expected to report modest sequential revenue growth for the July–September quarter, with margins remaining largely steady as deal ramp-ups and cost factors offset each other.

Bloomberg consensus sees revenue at Rs 22,680 crore, up 2% from Rs 22,135 crore, while profit is seen down 2% at Rs 3,279 crore. Ebitda is expected to rise 5% to Rs 4,457 crore, with the margin near 19.65% versus 19.14% in the prior quarter. Analysts will focus on guidance for the next quarter and the impact of large deal ramps on near-term margin.

The quarter will test how recently won large deals affect operating profit as ramp costs feed through. Market attention will centre on Q3 guidance, consulting and Europe demand, and commentary on discretionary spend and any cost headwinds linked to deal ramps.

Read full story below:

Q2 FY26 Results Today Live : Infosys, Eternal, Jio Financial To Watch

In the ongoing earnings season, many big companies across sectors are scheduled to announce their results for the second quarter of the current financial year on Thursday. As many as 62 companies will declare their quarterly performance results for Q2FY26 on October 16.

Major companies announcing their second-quarter results include Wipro, Infosys, Eternal (formerly Zomato), Jio Financial Services, and Nestle India, among others.

Many companies are also expected to announce an interim dividend for shareholders. Several companies have also announced the schedule for their earnings call to discuss the Q2FY26 results.

. Read more on Earnings by NDTV Profit.