The 200-day Exponential Moving Average (200-D EMA) is a popular technical indicator used to track a stock’s long-term price trend. Unlike the simple moving average, it gives more weight to recent prices, making it more responsive to market changes. Investors and traders often use the 200-D EMA to determine whether a stock is in a sustained upward or downward trend over time.

When a stock finds support at the 200-D EMA, it shows that the price is rebounding from this level, indicating underlying strength. This is typically seen as a bullish signal, reflecting rising buying interest and potential for further gains. In this article, we highlight five stocks exhibiting positive momentum near this key support zone.

Here are a few stocks that are taking support of the 200-day exponential moving average (200-D EMA)

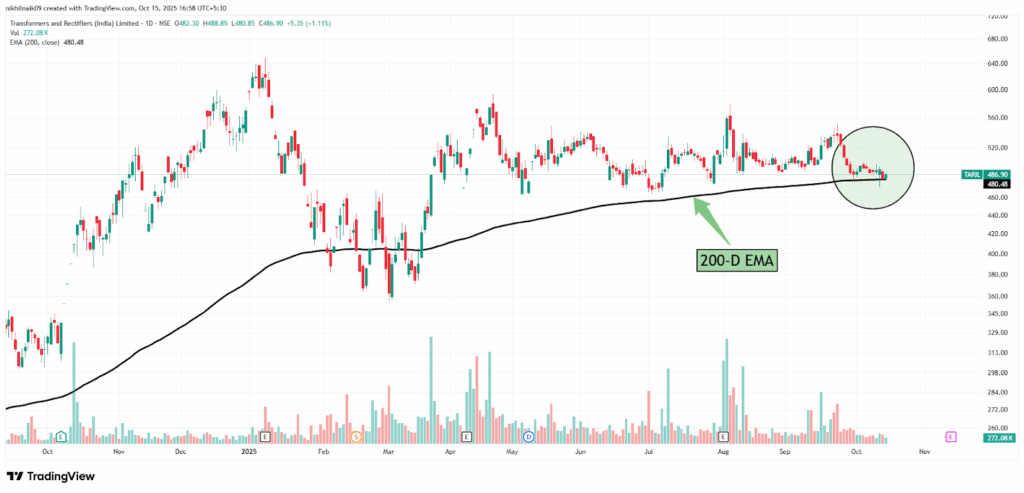

Transformers and Rectifiers India Limited

Transformers and Rectifiers India Limited was established in 1994 and is engaged in manufacturing a wide range of transformers, including power, distribution, furnace, and specialized types. The company operates from two modern facilities in Ahmedabad, serving domestic and international markets.

The stock is taking support of the 200-day exponential moving average (200-D EMA) at a price of approximately Rs. 480.48. The stock closed at Rs. 486.90 in Wednesday’s session, reflecting a 1.11 percent increase in the intraday trade.

Intellect Design Arena Limited

Intellect Design Arena Limited was incorporated in 2011 and is headquartered in Chennai. The company is engaged in developing and marketing advanced financial technology software. It serves global banking, insurance, and financial institutions with digital banking, treasury, risk management, and wealth management solutions.

The stock is taking support of the 200-day exponential moving average (200-D EMA) at a price of approximately Rs. 965.05. The stock closed at Rs. 994.95 in Wednesday’s session, reflecting a 3.91 percent increase in the intraday trade.

DCM Shriram Limited

DCM Shriram Limited was established in 1990 following the restructuring of DCM Group and is engaged in diverse businesses, including agro-rural products like fertilizers and seeds, chemicals such as chlor-alkali, and value-added products like sugar and building systems.

The stock is taking support of the 200-day exponential moving average (200-D EMA) at a price of approximately Rs. 1,177.79. The stock closed at Rs. 1,201.80 in Wednesday’s session, reflecting a 3.03 percent increase in the intraday trade.

Written By – Nikhil Naik

Disclaimer

The views and investment tips expressed by investment experts/broking houses/rating agencies on tradebrains.in are their own, and not that of the website or its management. Investing in equities poses a risk of financial losses. Investors must therefore exercise due caution while investing or trading in stocks. Trade Brains Technologies Private Limited or the author are not liable for any losses caused as a result of the decision based on this article. Please consult your investment advisor before investing.

The post 3 Nifty 500 stocks that are taking support at the 200-D EMA to keep an eye on appeared first on Trade Brains.