The rupee settled sharply higher against the US dollar, despite paring some gains from its intraday high. The Reserve Bank of India (RBI) intervened in the foreign exchange market to safeguard rupee from runaway depreciation, according to forex traders.

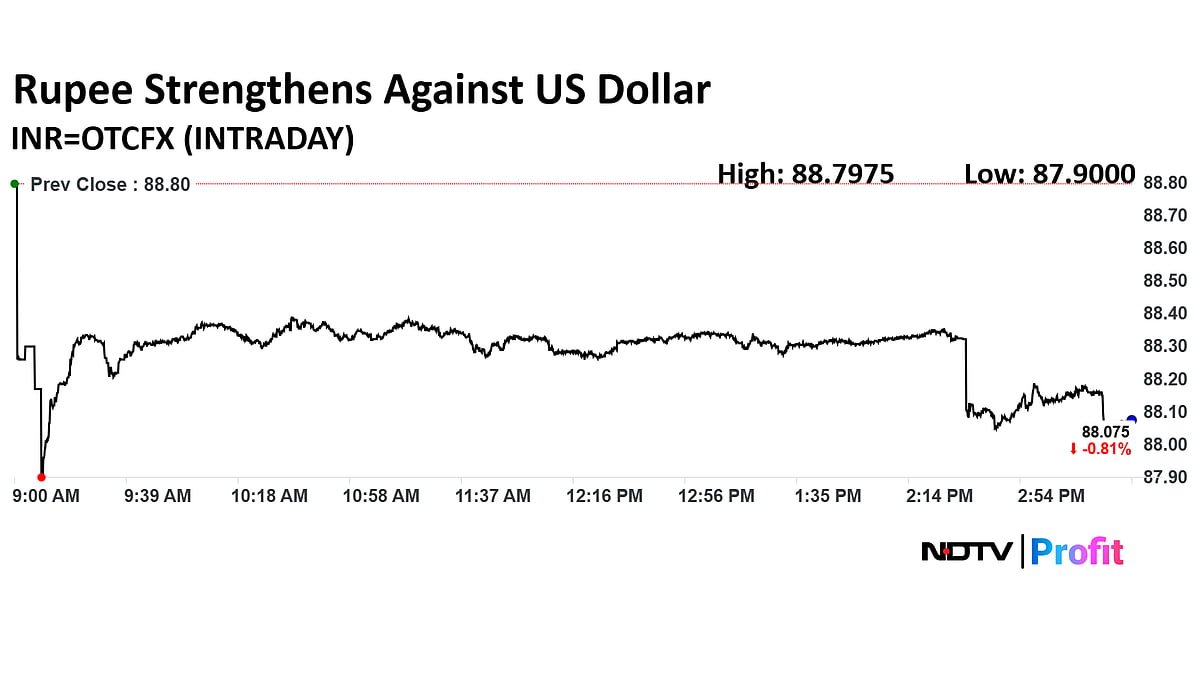

The Indian currency settled 73 paise stronger against US dollar at 88.07. It has emerged as the best performing Asian currency with 0.82% appreciation against the greenback.

During the session, the rupee jumped 81 paise to near one-month high of 87.99. The domestic unit strengthened above 87 level for the first time since Sept 18, according to data on Bloomberg.

The Indian currency ended at 88.80 a dollar on Tuesday.

Heavy intervention by the RBI has jolted everyone awake. Those holding long positions against rupee have started cutting their positions. The rupee is heavily undervalued in the market As trade deal takes shape, market participants will see central bank interventions rise. All tools are currently on the table, including further forex swaps by RBI, forex traders said.

Forex traders expects the rupee to move in the range of 86-87.50 a dollar as the deal get signed.

The central bank did forex swaps over the past week to inject liquidity into the system as it tries to offset the impact intervention in the offshore and onshore markets, according to Bloomberg. RBI has been restricting the rupee from depreciating past 89.00 a dollar level.

. Read more on Economy & Finance by NDTV Profit.