Synopsis:

Hindustan Unilever Limited’s Q2FY26 revenue rose 2.1% YoY to Rs. 16,034 Crores, and net profit increased 3.8% to Rs. 2,694 Crores. The company also declared a Rs. 19 interim dividend (1900%).

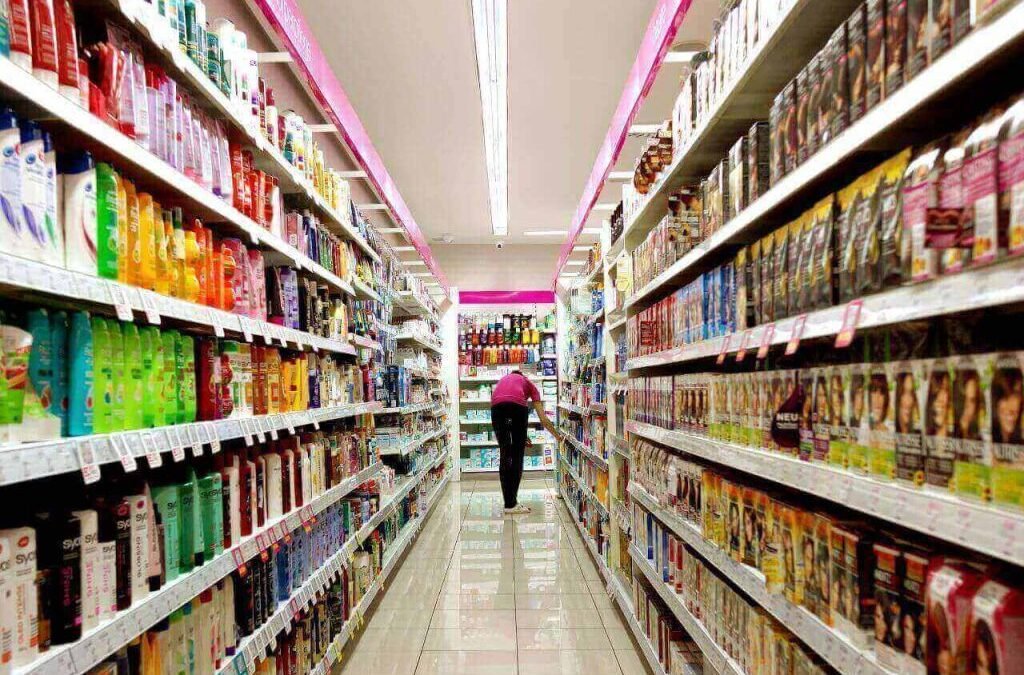

The shares of the FMCG stock company, specializing in the Fast-Moving Consumer Goods (FMCG) industry, with its primary business segments focused on Home Care, Beauty & Personal Care, and Foods & Refreshment, jumped to 3 percent following their announcement of Q2 results and Dividend.

With a market capitalization of 6,14,841.04 Crores on Thursday, the shares of Hindustan Unilever Ltd jumped upto 2.9 percent, reaching a high of Rs. 2667.55 compared to its previous close of Rs. 2592.30.

What Happened

Hindustan Unilever Ltd, engaged in the Fast-Moving Consumer Goods (FMCG) industry, with its primary business segments focused on Home Care, Beauty & Personal Care, and Foods & Refreshment, has announced its Q2 results as follows:

Its Revenue from operations rose by 2.1 percent YoY from Rs. 15,703 Crores in Q2FY25 to Rs. 16,034 Crores in Q2FY26, and it declined by 1.6 percent QoQ from Rs. 16,296 Crores in Q1FY26 to Rs. 16,034 Crores in Q2FY26.

Its Net Profit YoY rose by 3.8 percent from Rs. 2,595 Crores in Q2FY25 to Rs. 2,694 Crores in Q2FY26, and it declined by 2.6 percent QoQ from Rs. 2,768 Crores in Q1FY26 to Rs. 2,694 Crores in Q2FY26. The earnings per share (EPS) for the quarterly period stood at Rs. 11.43, compared to Rs. 11.03 in the previous quarter.

Along with it, the company declared an interim dividend of Rs. 19 per share (face value Re. 1) (1,900%) for the financial year ending March 31, 2026. Shareholders eligible for this dividend will be determined based on the record date of Friday, November 7, 2025, and the dividend will be paid on Thursday, November 20, 2025.

The company has a strong financial performance with a Return on Capital Employed (ROCE) of 27.8% and a Return on Equity (ROE) of 20.7%. Its debt-to-equity ratio is very low at 0.03, indicating that the company is almost debt-free. Additionally, the company has been maintaining a healthy dividend payout ratio of 101%, reflecting its commitment to returning value to shareholders.

Priya Nair, CEO and Managing Director, said: “The latest GST reforms are a positive step by the Government to drive consumption, expected to increase disposable income and improve consumer sentiment. However, the quarter saw a temporary impact as the market adjusted to these changes. We anticipate normal trading conditions from early November, once prices stabilize, paving the way for a gradual and sustained market recovery. Margins are expected to remain at current levels, excluding ice cream, to support business investment.”

Company Overview & Others

Hindustan Unilever Limited (HUL) is India’s largest fast-moving consumer goods (FMCG) company, a subsidiary of Unilever, with over 90 years of service to Indian households. It has a diverse portfolio of brands in categories like home and personal care, food, and beverages, and reaches about 9 out of 10 Indian households through its extensive distribution network. HUL has a strong presence in both urban and rural markets, serving millions of consumers daily.

The company is known for its iconic brands like Dove, Surf Excel, Lipton, and Lux, and focuses heavily on innovation, sustainability, and community initiatives. HUL is part of the global Unilever group and consistently delivers strong financial performance, making it a leader in the Indian FMCG sector.

Near-Term Outlook

Growth is expected to improve after GST-related disruptions ease by November, with price growth likely in the low single digits if commodity prices stay stable. The second half of FY’26 is anticipated to perform better than the first. EBITDA margins should hold steady, excluding Ice Cream, to support business investments. The focus remains on competitive volume-led growth.

Written by Sridhar J

Disclaimer

The views and investment tips expressed by investment experts/broking houses/rating agencies on tradebrains.in are their own, and not that of the website or its management. Investing in equities poses a risk of financial losses. Investors must therefore exercise due caution while investing or trading in stocks. Trade Brains Technologies Private Limited or the author are not liable for any losses caused as a result of the decision based on this article. Please consult your investment advisor before investing.

The post 1,900% Dividend: FMCG stock jumps 3% after announcing Q2 results and dividend appeared first on Trade Brains.